Indirect tax

Such taxes raise revenue and at the same time they correct a market failure through increasing price of the good and thus decreasing its consumption.

The economy benefits from the reduced extent of the negative externality and from lower reliance on other taxes that distort production.

[13] Apart from generating revenue and reducing the consumption of goods creating negative externalities, excise taxes can be tailored to impose tax burdens on those who cause the negative externality or those who benefit from government services.

Specific and ad valorem taxes have identical consequences in competitive markets apart from differences in compliance and enforcement.

[13] Moreover, VAT is associated with relatively low administrative costs due to lower enforcement and collection costs due to the fact that VAT is collected throughout the production chain, which allows for the comparison of reported sales on each stage of the vertical production chain by the fiscal authority.

During the 1940s, its application grew from a historical average[20] of about 8% to around 90% of the population paying it as a measure to support the war effort.

This largely explains why the actual burden on farmers is still not light after China's abolition of the agricultural tax.

Whether it is financing the economic stimulus plan or gradually making up for the funding gap caused by the economic shock, indirect taxes have proven to be the first choice for income generation for many years and will continue to be so in the future.

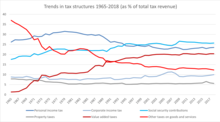

The large number of advocates who promote the shift from direct to indirect taxes can explain this trend, such as the International Monetary Fund (IMF), the Organization for Economic Cooperation and Development (OECD), and the European Commission.

Indirect taxes, by definition, are borne by consumers, do not depend on profits, and are limited by the economic situation.

In addition, the number of countries with "value-added tax" continues to grow, especially in emerging economies.

The tax reform plan entrusted by the Puerto Rico government to the research team will increase general fund revenue, simplify overall compliance and promote economic growth.

This upward trend is particularly significant in Europe and OECD countries, where the average standard value-added rate has reached 21.6% (EU member states) and 19.2% (OECD member states), while only 19.5% and 17.5% before 2008 economic crisis.

Tobacco excise taxes will increase in many countries, including Denmark, Ecuador, Finland, Ghana, Malta, Ireland, the Netherlands, Norway, Russia, Slovenia, Sweden, and Tanzania.

The countries that have increased the consumption tax on alcohol are Lithuania, Norway, and Tanzania.

In addition, mineral oil consumption taxes have increased in China, Estonia, Finland, Gambia, Hungary, Norway, and Russia.

Italy subsequently imposed taxes on equity transfer derivatives and high-frequency trading in March 2013.

However, 11 EU countries that will impose daily transaction taxes on stock and bond exchanges and derivative contract schemes (FTT) have further delayed their taxation.

The 11 member states participating in the meeting have agreed to impose this tax in January 2016.

Indirect taxes are usually subject to economic transactions, such as the sale of goods or the provision of labor services.

To give an example that clearly undermines the indirect tax system is the rise of e-commerce.

Such an important development means a huge change: it will cause distortions in competition between local and foreign suppliers and will have a major effect on VAT revenue, especially when it involves sales to end consumers (i.e. B2C transactions).

The international community responded quickly to this new reality, and in 1998, the OECD member states unanimously adopted the "Ottawa Taxation Framework Conditions[22]" on e-commerce taxation: However, in most countries, there is no complete and unified plan for the collection of e-commerce taxes.

In recent years, governments all over the world have realized that incomplete legislation has brought a huge loss of fiscal revenue, and have begun to actively implement new rules.

Recent examples of how the digital economy affects value-added tax laws include the EU's changes to the new regulations promulgated on 1 January 2015, for B2C electronic service providers.

The most recent trend is to apply sales and use taxes to trade intangible assets (remote access to electronic delivery software, digital music, and books).

Many states have announced that they are considering expanding sales to cover a wider range of service transactions.