Interest rate swap

In its December 2014 statistics release, the Bank for International Settlements reported that interest rate swaps were the largest component of the global OTC derivative market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion.

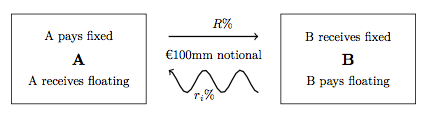

The most common IRS is a fixed for floating swap, whereby one party will make payments to the other based on an initially agreed fixed rate of interest, to receive back payments based on a floating interest rate index.

The floating index is commonly an interbank offered rate (IBOR) of specific tenor in the appropriate currency of the IRS, for example LIBOR in GBP, EURIBOR in EUR, or STIBOR in SEK.

[3] As OTC instruments, interest rate swaps (IRSs) can be customised in a number of ways and can be structured to meet the specific needs of the counterparties.

The pricing of these swaps requires a spread often quoted in basis points to be added to one of the floating legs in order to satisfy value equivalence.

They are also used to manage cashflows by converting floating to fixed interest payments, or vice versa.

Varying levels of creditworthiness means that there is often a positive quality spread differential that allows both parties to benefit from an interest rate swap.

Typically these will have none of the above customisations, and instead exhibit constant notional throughout, implied payment and accrual dates and benchmark calculation conventions by currency.

The PV of the IRS from the perspective of receiving the fixed leg is then: Historically IRSs were valued using discount factors derived from the same curve used to forecast the -IBOR rates.

It became more apparent with the 2007–2008 financial crisis that the approach was not appropriate, and alignment towards discount factors associated with physical collateral of the IRSs was needed.

Post crisis, to accommodate credit risk, the now-standard pricing approach is the multi-curve framework, applied where forecast discount factors and -IBOR (the erstwhile reference rate) exhibit disparity.

Here, overnight index swap (OIS) rates are typically used to derive discount factors, since that index is the standard inclusion on Credit Support Annexes (CSAs) to determine the rate of interest payable on collateral for IRS contracts.

[4] Regarding the curve build, see: [5] [6] [2] Under the old framework a single self-discounted curve was "bootstrapped" for each tenor; i.e.: solved such that it exactly returned the observed prices of selected instruments—IRSs, with FRAs in the short end—with the build proceeding sequentially, date-wise, through these instruments.

Here, since the observed average overnight rate is swapped for the -IBOR rate over the same period (the most liquid tenor in that market), and the -IBOR IRSs are in turn discounted on the OIS curve, the problem entails a nonlinear system, where all curve points are solved at once, and specialized iterative methods are usually employed — very often a modification of Newton's method.

((v) All that need be stored are the solved spot rates for the pillar points, and the interpolation rule.)

As required, a third-currency discount curve — i.e. for local trades collateralized in a currency other than local or USD (or any other combination) — can then be constructed from the local-currency basis-curve and third-currency basis-curve, combined via an arbitrage relationship known here as "FX Forward Invariance".

[11] LIBOR is being phased out, with replacements including SOFR and TONAR ("market reference rates", MRRs, as based on secured overnight funding transactions).

With the coexistence of "old" and "new" rates in the market, multi-curve and OIS curve "management" is necessary, with changes required to incorporate new discounting and compounding conventions, while the underlying logic is unaffected; see.

(The way these changes in value are reported is the subject of IAS 39 for jurisdictions following IFRS, and FAS 133 for U.S.

Regardless, due to regulations set out in the Basel III Regulatory Frameworks, trading interest rate derivatives commands a capital usage.

The consequence of this is that, dependent upon their specific nature, interest rate swaps might command a high capital usage, possibly sensitive to market movements.

[16] Debt security traders, daily mark to market their swap positions so as to "visualize their inventory" (see product control).

Since the cash flows of component swaps offset each other, traders will implement this hedging on a net basis for entire books.

[17] Here, the trader would typically hedge her interest rate risk through offsetting Treasuries (either spot or futures).

Often, a specialized XVA-desk centrally monitors and manages overall CVA and XVA exposure and capital, and will then implement this hedge.

Note, however, (and re P&L Attribution) that the multi-curve framework adds complexity in that (individual) positions are (potentially) affected by numerous instruments not obviously related.

This enhances the benchmark's robustness and reliability by protecting against attempted manipulation and temporary aberrations in the underlying market.

[citation needed] The market-making of IRSs is an involved process involving multiple tasks; curve construction with reference to interbank markets, individual derivative contract pricing, risk management of credit, cash and capital.

The cross disciplines required include quantitative analysis and mathematical expertise, disciplined and organized approach towards profits and losses, and coherent psychological and subjective assessment of financial market information and price-taker analysis.

General: Early literature on the incoherence of the one curve pricing approach: Multi-curves framework: and are regarded as an