Macroeconomics

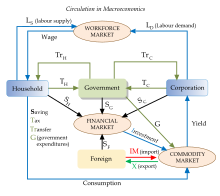

[4] The focus of macroeconomics is often on a country (or larger entities like the whole world) and how its markets interact to produce large-scale phenomena that economists refer to as aggregate variables.

In microeconomics the focus of analysis is often a single market, such as whether changes in supply or demand are to blame for price increases in the oil and automotive sectors.

[5]: 39 Besides, the time horizon varies for different types of macroeconomic topics, and this distinction is crucial for many research and policy debates.

Economists look for macroeconomic policies that prevent economies from slipping into either recessions or overheating and that lead to higher productivity levels and standards of living.

People who are retired, pursuing education, or discouraged from seeking work by a lack of job prospects are not part of the labor force and consequently not counted as unemployed, either.

There may be several reasons why there is some positive unemployment level even in a cyclically neutral situation, which all have their foundation in some kind of market failure:[6] A general price increase across the entire economy is called inflation.

Central bankers conducting monetary policy usually have as a main priority to avoid too high inflation, typically by adjusting interest rates.

It explores what determines import, export, the balance of trade and over longer horizons the accumulation of net foreign assets.

[18][19][5]: 526 The terms "macrodynamics" and "macroanalysis" were introduced by Ragnar Frisch in 1933, and Lawrence Klein in 1946 used the word "macroeconomics" itself in a journal title in 1946.

In the first decades of the 20th century monetary theory was dominated by the eminent economists Alfred Marshall, Knut Wicksell and Irving Fisher.

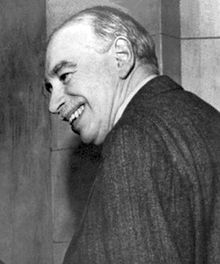

[18] When the Great Depression struck, the reigning economists had difficulty explaining how goods could go unsold and workers could be left unemployed.

In the prevailing neoclassical economics paradigm, prices and wages would drop until the market cleared, and all goods and labor were sold.

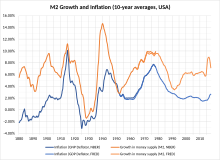

He argued that the role of money in the economy was sufficient to explain the Great Depression, and that aggregate demand oriented explanations were not necessary.

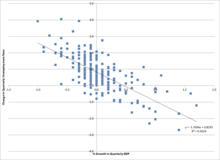

Friedman and Edmund Phelps (who was not a monetarist) proposed an "augmented" version of the Phillips curve that excluded the possibility of a stable, long-run tradeoff between inflation and unemployment.

Monetarism was particularly influential in the early 1980s, but fell out of favor when central banks found the results disappointing when trying to target money supply instead of interest rates as monetarists recommended, concluding that the relationships between money growth, inflation and real GDP growth are too unstable to be useful in practical monetary policy making.

[5]: 530 Consumers will not simply assume a 2% inflation rate just because that has been the average the past few years; they will look at current monetary policy and economic conditions to make an informed forecast.

He advocated models based on fundamental economic theory (i.e. having an explicit microeconomic foundation) that would, in principle, be structurally accurate as economies changed.

[5]: 530 Following Lucas's critique, new classical economists, led by Edward C. Prescott and Finn E. Kydland, created real business cycle (RBC) models of the macro economy.

Critics of RBC models argue that technological changes, which typically diffuse slowly throughout the economy, could hardly generate the large short-run output fluctuations that we observe.

In addition, there is strong empirical evidence that monetary policy does affect real economic activity, and the idea that technological regress can explain recent recessions seems implausible.

[6]: 194 New Keynesian economists responded to the new classical school by adopting rational expectations and focusing on developing micro-founded models that were immune to the Lucas critique.

Stanley Fischer and John B. Taylor produced early work in this area by showing that monetary policy could be effective even in models with rational expectations when contracts locked in wages for workers.

Other new Keynesian economists, including Olivier Blanchard, Janet Yellen, Julio Rotemberg, Greg Mankiw, David Romer, and Michael Woodford, expanded on this work and demonstrated other cases where various market imperfections caused inflexible prices and wages leading in turn to monetary and fiscal policy having real effects.

Solow's model suggests that economic growth in terms of output per capita depends solely on technological advances that enhance productivity.

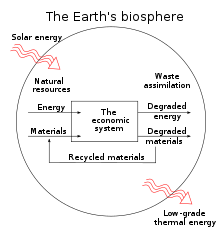

[7]: 201–39 More recently, the issue of climate change and the possibilities of a sustainable development are examined in so-called integrated assessment models, pioneered by William Nordhaus.

Automatic stabilizers use conventional fiscal mechanisms, but take effect as soon as the economy takes a downturn: spending on unemployment benefits automatically increases when unemployment rises, and tax revenues decrease, which shelters private income and consumption from part of the fall in market income.

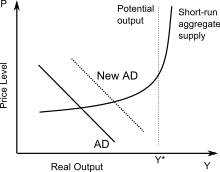

[7]: 657 There is a general consensus that both monetary and fiscal instruments may affect demand and activity in the short run (i.e. over the business cycle).

[7]: 657 Economists usually favor monetary over fiscal policy to mitigate moderate fluctuations, however, because it has two major advantages.

[5] Thirdly, in regimes where monetary policy is tied to fulfilling other targets, in particular fixed exchange rate regimes, the central bank cannot simultaneously adjust its interest rates to mitigate domestic business cycle fluctuations, making fiscal policy the only usable tool for such countries.

[49] A problem related to the LM curve is that modern central banks largely ignore the money supply in determining policy, contrary to the model's basic assumptions.