Circular flow of income

The flows of money and goods exchanged in a closed circuit correspond in value, but run in the opposite direction.

[4] Important developments of Quesnay's tableau were Karl Marx's reproduction schemes in the second volume of Capital: Critique of Political Economy, and John Maynard Keynes' General Theory of Employment, Interest and Money.

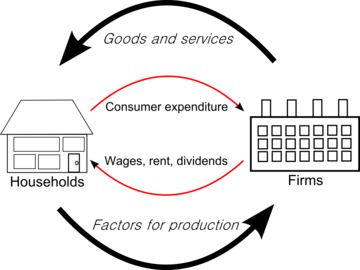

In its most basic form it considers a simple economy consisting solely of businesses and individuals, and can be represented in a so-called "circular flow diagram."

In this simple economy, individuals provide the labour that enables businesses to produce goods and services.

The circular flow also illustrates the equality between the income earned from production and the value of goods and services produced.

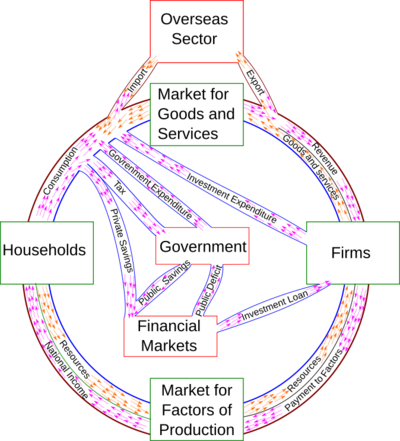

An economy involves interactions between not only individuals and businesses, but also Federal, state, and local governments and residents of the rest of the world.

Also not shown in this simple illustration of the economy are other aspects of economic activity such as investment in capital (produced—or fixed—assets such as structures, equipment, research and development, and software), flows of financial capital (such as stocks, bonds, and bank deposits), and the contributions of these flows to the accumulation of fixed assets.

[7] Cantillon described the concept in his 1730 Essay on the Nature of Trade in General, in chapter 11, entitled "The Par or Relation between the Value of Land and Labor" to chapter 13, entitled "The Circulation and Exchange of Goods and Merchandise, as well as their Production, are Carried On in Europe by Entrepreneurs, and at a Risk."

(2010) further explained: François Quesnay further developed these concepts, and was the first to visualize these interactions over time in the so-called Tableau économique.

Karl Marx developed the original insights of Quesnay to model the circulation of capital, money, and commodities in the second volume of Das Kapital to show how the reproduction process that must occur in any type of society can take place in capitalist society by means of the circulation of capital.

An important development was John Maynard Keynes's 1933 publication of the General Theory of Employment, Interest and Money.

The first to visualize the modern circular flow of income model was Frank Knight in 1933 publication of The Economic Organization.

[13] Knight (1933) explained: Knight pictured a circulation of money and circulation of economic value between people (individuals, families) and business enterprises as a group,[15] explaining: "The general character of an enterprise system, reduced to its very simplest terms, can be illustrated by a diagram showing the exchange of productive power for consumption goods between individuals and business units, mediated by the circulation of money, and suggesting the familiar figure of the wheel of wealth.

[2] In the basic two-sector circular flow of income model, the economy consists of two sectors: (1) households and (2) firms.

The income the government receives flows to firms and households in the form of subsidies, transfers, and purchases of goods and services.

[19] Thus, the five-sector model includes (1) households, (2) firms, (3) government, (4) the rest of the world, and (5) the financial sector.

The financial sector includes banks and non-bank intermediaries that engage in borrowing (savings from households) and lending (investments in firms).

This is a leakage because the saved money cannot be spent in the economy and thus is an idle asset that means not all output will be purchased.

If S + T + M > I + G + X the levels of income, output, expenditure and employment will fall causing a recession or contraction in the overall economic activity.

But if S + T + M < I + G + X the levels of income, output, expenditure and employment will rise causing a boom or expansion in economic activity.

To manage this problem, if disequilibrium were to occur in the five sector circular flow of income model, changes in expenditure and output will lead to equilibrium being regained.

The other equation of disequilibrium, if S + T + M < I + G + X in the five sector model the levels of income, expenditure and output will greatly rise causing a boom in economic activity.

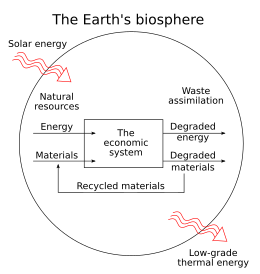

[25] The abstraction ignores the linear throughput of matter and energy that must power the continuous motion of money, goods and services, and factors of production.

However, it cannot be ignored that the economy intrinsically requires natural resources and the creation of waste that must be absorbed in some manner.

This matter and low entropy energy and the ability to absorb waste exists in a finite amount, and thus there is a finite amount of inputs to the flow and outputs of the flow that the environment can handle, implying there is a sustainable limit to motion, and therefore growth, of the economy.