Market structure

Empirical methods Prescriptive and policy Market structure, in economics, depicts how firms are differentiated and categorised based on the types of goods they sell (homogeneous/heterogeneous) and how their operations are affected by external factors and elements.

Suppliers and Demanders (sellers and buyers) will aim to find a price that both parties can accept creating a equilibrium quantity.

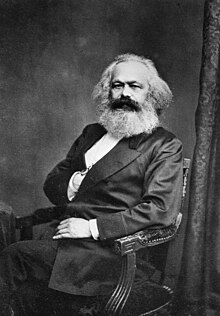

Adam Smith in his writing on economics stressed the importance of laissez-faire principles outlining the operation of the market in the absence of dominant political mechanisms of control, while Karl Marx discussed the working of the market in the presence of a controlled economy[2] sometimes referred to as a command economy in the literature.

The elements of Market Structure include the number and size of sellers, entry and exit barriers, nature of product, price, selling costs.

Market structure can alter based on the new external factors, such as technology, consumer preferences and new entrants.

Competition is useful because it reveals actual customer demand and induces the seller (operator) to provide service quality levels and price levels that buyers (customers) want, typically subject to the seller's financial need to cover its costs.

In today's time, Karl Marx's theory about political influence on market makes sense as firms and industry are affected strongly by the regulation, taxes, tariffs, patents imposed by the government.

[14] Monopolies have complete market control as the barriers to entry are high and the threat of new entrants is low; therefore they can price set to their preference.

Oligopoly: The number of enterprises is small, entry and exit from the market are restricted, product attributes are different, and the demand curve is downward sloping and relatively inelastic.

Oligopolies are usually found in industries in which initial capital requirements are high and existing companies have strong foothold in market share.

Different aspects that have been taken into account to measures the innovative advantage within particular market structures are: the size distribution of firms, the existence of certain barriers to entry, and the stage of industry in the product lifecycle.