Modified gross national income

While "Inflated GDP-per-capita" due to BEPS tools is a feature of tax havens,[1][2] Ireland was the first to adjust its GDP metrics.

[12][13] Designed by PwC (Ireland) tax partner, Feargal O'Rourke,[14][15] the double Irish would become the largest BEPS tool in history, and would enable US multinationals to accumulate over US$1 trillion in untaxed offshore profits.

[21][22] During the Irish financial crisis from 2009 to 2012, two catalysts would restart the distortion of Irish economic statistics: In 2010, Hines published a new list of 52 global tax havens, the Hines 2010 list, which ranked Ireland as the 3rd largest tax haven in the world.

[39] The announcement led to ridicule,[40][41][42][43][44][45][46] and was labelled by Nobel Prize economist Paul Krugman as "leprechaun economics".

[47] From July 2016 to July 2018, the Central Statistics Office refused to identify the source of leprechaun economics, and suppressed the release of other economic data to protect Apple's identity under the 1993 Central Statistics Act,[48][49] in the manner of a "captured state", further damaging confidence in Ireland.

It is not clear if this was due to the confusion caused by the Central Statistics Office (Ireland) in protecting Apple's identity for 2 years, or other reasons.

In September 2016, as a direct result of the "leprechaun economics" affair, the Governor of the Central Bank of Ireland ("CBI"), Philip R. Lane, chaired a special cross-economic steering group, the Economic Statistics Review Group ("ESRG"), of stakeholders (incl.

CBI, IFAC, ESRI, NTMA, leading academics and the Department of Finance), to recommend new economic statistics that would better represent the true position of the Irish economy.

The difference between GNI* and GNI is due to having to deal with two problems (a) The retained earnings of re-domiciled firms in Ireland (where the earnings ultimately accrue to foreign investors), and (b) depreciation on foreign-owned capital assets located in Ireland, such as intellectual property (which inflate the size of Irish GDP, but again the benefits accrue to foreign investors).

[67][68] Zucman also showed that Irish BEPS flows were becoming so large, that they were artificially exaggerating the scale of the EU-US trade deficit.

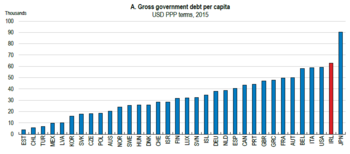

[5] Another study published in June 2018 by the IMF called into question the economic data of all leading tax havens, and the artificial effect of their BEPS tools.

(‡) Eurostat show that GNI* is also still distorted by certain BEPS tools, and specifically contract manufacturing, which is a significant activity in Ireland.