Mechanism design

It studies how to construct rules—called mechanisms or institutions—that produce good outcomes according to some predefined metric, even when the designer does not know the players' true preferences or what information they have.

Mechanism design thus focuses on the study of solution concepts for a class of private-information games.

It is a foundational component in the operation of the internet, being used in networked systems (such as inter-domain routing),[2] e-commerce, and advertisement auctions by Facebook and Google.

[2] Leonid Hurwicz explains that "in a design problem, the goal function is the main given, while the mechanism is the unknown.

Therefore, the design problem is the inverse of traditional economic theory, which is typically devoted to the analysis of the performance of a given mechanism.

"[3] The 2007 Nobel Memorial Prize in Economic Sciences was awarded to Leonid Hurwicz, Eric Maskin, and Roger Myerson "for having laid the foundations of mechanism design theory.

"[4] The related works of William Vickrey that established the field earned him the 1996 Nobel prize.

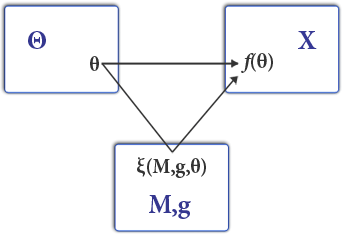

One person, called the "principal", would like to condition his behavior on information privately known to the players of a game.

Thanks to the revelation principle, the principal only needs to consider games in which agents truthfully report their private information.

Following Harsanyi (1967), the agents receive secret "messages" from nature containing information relevant to payoffs.

At equilibrium agents choose their reports strategically as a function of type It is difficult to solve for Bayesian equilibria in such a setting because it involves solving for agents' best-response strategies and for the best inference from a possible strategic lie.

Thanks to a sweeping result called the revelation principle, no matter the mechanism a designer can[5] confine attention to equilibria in which agents truthfully report type.

The principle allows one to solve for a Bayesian equilibrium by assuming all players truthfully report type (subject to an incentive compatibility constraint).

is Nash in expected utility: Simply define a mechanism that would induce agents to choose the same equilibrium.

Additionally, a participation (individual rationality) constraint is sometimes added if agents have the option of not playing.

The second piece is a monotonicity condition waiting to happen,[clarification needed] which, to be positive, means higher types must be given more of the good.

In a multiple-good environment it is also possible for the designer to reward the agent with more of one good to substitute for less of another (e.g. butter for margarine).

An implication is that for the seller to achieve higher revenue he must take a chance on giving the item to an agent with a lower valuation.

In other words, it can solve the "tragedy of the commons"—under certain conditions, in particular quasilinear utility or if budget balance is not required.

A social choice function f() is dictatorial if one agent always receives his most-favored goods allocation, The theorem states that under general conditions any truthfully implementable social choice function must be dictatorial if, Myerson and Satterthwaite (1983) show there is no efficient way for two parties to trade a good when they each have secret and probabilistically varying valuations for it, without the risk of forcing one party to trade at a loss.

[6] A symmetrical statement is similarly valid for utility-sharing games with convex utility functions.

Consider a single-good, single-agent setting in which the agent has quasilinear utility with an unknown type parameter

The principal can produce goods at a convex marginal cost c(x) and wants to maximize the expected profit from the transaction subject to IC and IR conditions The principal here is a monopolist trying to set a profit-maximizing price scheme in which it cannot identify the type of the customer.

Due to the IR condition it has to give every type a good enough deal to induce participation.

A trick given by Mirrlees (1971) is to use the envelope theorem to eliminate the transfer function from the expectation to be maximized, Integrating, where

If the type distribution bears the monotone hazard ratio property, the FOC is sufficient to solve for t().

In some applications the designer may solve the first-order conditions for the price and allocation schedules yet find they are not monotonic.

As before maximize the principal's expected payoff, but this time subject to the monotonicity constraint and use a Hamiltonian to do it, with shadow price

As usual in optimal control the costate evolution equation must satisfy Taking advantage of condition 2, note the monotonicity constraint is not binding at the boundaries of the

interval, meaning the costate variable condition can be integrated and also equals 0 The average distortion of the principal's surplus must be 0.