Real and nominal value

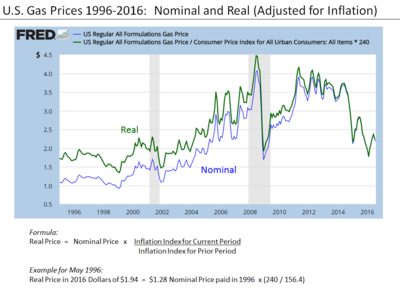

Empirical methods Prescriptive and policy In economics, nominal value refers to value measured in terms of absolute money amounts, whereas real value is considered and measured against the actual goods or services for which it can be exchanged at a given time.

In macroeconomics, the real gross domestic product compensates for inflation so economists can exclude inflation from growth figures, and see how much an economy actually grows.

Nominal GDP would include inflation, and thus be higher.

At a single point of time, a commodity bundle consists of a list of goods, and each good in the list has a market price and a quantity.

The nominal value of the commodity bundle at a point of time is the total market value of the commodity bundle, depending on the market price, and the quantity, of each good in the commodity bundle which are current at the time.

A price index can be measured over time, or at different locations or markets.

A time series price index is calculated relative to a base or reference date.

The price index is typically normalized to start at 100 at the base date, so

and the next one, is normally constant regular time interval, such as a calendar year.

, divided by the value of the commodity bundle at the base date.

If the price of the commodity bundle has increased by one percent over the first period after the base date, then P1 = 101.

The nominal value of a commodity bundle tends to change over time.

In contrast, by definition, the real value of the commodity bundle in aggregate remains the same over time.

The real values of individual goods or commodities may rise or fall against each other, in relative terms, but a representative commodity bundle as a whole retains its real value as a constant from one period to the next.

Real values can for example be expressed in constant 1992 dollars, with the price level fixed 100 at the base date.

The price index is applied to adjust the nominal value

of a quantity, such as wages or total production, to obtain its real value.

The index price divided by its base-year value

Using the price index growth factor as a divisor for converting a nominal value into a real value, the real value at time t relative to the base date is: The real growth rate

It measures by how much the buying power of the quantity has changed over a single period.

between −1 and 1 (i.e. ±100 percent), we have the Taylor series so Hence as a first-order (i.e. linear) approximation, The bundle of goods used to measure the Consumer Price Index (CPI) is applicable to consumers.

Gross domestic product (GDP) is a measure of aggregate output.

In the U.S. National Income and Product Accounts, nominal GDP is called GDP in current dollars (that is, in prices current for each designated year), and real GDP is called GDP in [base-year] dollars (that is, in dollars that can purchase the same quantity of commodities as in the base year).

In this example, the real wage rate increased by 20 percent, meaning that an hour's wage would buy 20% more goods in year 2 compared with year 1.

As was shown in the section above on the real growth rate, where and as a first-order approximation, In the case where the growing quantity is a financial asset,

is the corresponding real interest rate; the first-order approximation

[1] Looking back into the past, the ex post real interest rate is approximately the historical nominal interest rate minus inflation.

For example, the total value of a good produced in a region of a country depends on both the amount and the price.

To compare the output of different regions, the nominal output in a region can be adjusted by repricing the goods at common or average prices.