Payroll

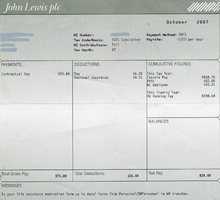

A payroll is a list of employees of a company who are entitled to receive compensation as well as other work benefits, as well as the amounts that each should obtain.

[1] Along with the amounts that each employee should receive for time worked or tasks performed, payroll can also refer to a company's records of payments that were previously made to employees, including salaries and wages, bonuses, and withheld taxes,[2] or the company's department that deals with compensation.

Payroll in the U.S. is subject to federal, state and local regulations including employee exemptions, record keeping, and tax requirements.

These platforms offer advantages such as cost savings, scalability, and real-time data access, making them increasingly popular among businesses of all sizes.

According to research conducted in February 2022 by the U.S. Department of Labor and the Bureau of Labor Statistics, the four most common pay frequencies in the United States were:[5] This frequency changes based on the establishment size, or the maximum number of employees within the business over the previous 12 months.

[13] Wage garnishments are post-tax deductions, meaning that these mandatory withholdings do not lower an employee's taxable income.

[citation needed][17] In many countries, business payrolls are complicated in that taxes must be filed consistently and accurately to applicable regulatory agencies.

For example, restaurant payrolls which typically include tip calculations, deductions, garnishments, and other variables, can be difficult to manage especially for new or small business owners.

As of 6 April 2016, umbrella companies are no longer able to offset travel and subsistence expenses and if they do, they will be deemed liable to reimburse HMRC any tax relief obtained.