Unemployment benefits

Depending on the country and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

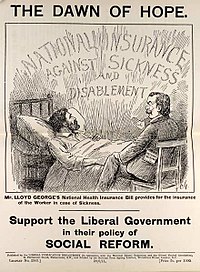

[5] The first modern unemployment benefit scheme was introduced in the United Kingdom with the National Insurance Act 1911, under the Liberal Party government of H. H. Asquith.

By the time of its implementation, the benefits were criticised by Communist parties, who saw such insurance as a means to prevent workers from starting a revolution, while employers and Tories sometimes saw it as a "necessary evil".

[8] The dole system provided 39 weeks of unemployment benefits to over 11,000,000 workers—practically the entire civilian working population except domestic service, farmworkers, railway men, and civil servants.

To be eligible for benefits, the claimant must be unemployed as a result of business reorganization, staff reduction, or the termination of a collective bargaining agreement.

To receive a JobSeeker Payment, recipients must be unemployed, be prepared to enter into an Employment Pathway Plan (previously called an Activity Agreement) by which they agree to undertake certain activities to increase their opportunities for employment, be Australian Residents and satisfy the income test (which limits weekly income to A$32 per week before benefits begin to reduce, until one's income reaches A$397.42 per week at which point no unemployment benefits are paid) and the assets test (an eligible recipient can have assets of up to A$161,500 if he or she owns a home before the allowance begins to reduce and $278,500 if he or she does do not own a home).

[12] On 22 February 2021, the Prime Minister of Australia, Scott Morrison, announced that the JobSeeker base rate would be increased by A$50 a fortnight from April 2021.

Premiums were reduced much less than falling expenditures – producing, from 1994 onwards, EI surpluses of several billion dollars per year, which were added to general government revenue.

[18] The cumulative EI surplus stood at $57 billion at 31 March 2008,[19] nearly four times the amount needed to cover the extra costs paid during a recession.

[23] Each Member State of the European Union has its own system and, in general, a worker should claim unemployment benefits in the country where they last worked.

France uses a quasi Ghent system, under which unemployment benefits are distributed by an independent agency (UNEDIC) in which unions and Employer organisations are equally represented.

In order to qualify, the unemployed person All workers with a regular employment contract (abhängig Beschäftigte), except freelancers and certain civil servants (Beamte), contribute to the system.

In exchange for that, beneficiaries are assisted in that process, e.g. by reimbursing travel expenses to interviews, receiving (free of charge) training in order to increase their chances on the labour market, or subsidising moving expenses once an employment contract has been signed but the place of work requires relocation as it is further than the acceptable daily commute duration (at most 3 hrs a day).

Beneficiaries not complying with orders can be sanctioned by pruning their allowance and eventually revoking the grant altogether, virtually pushing them into poverty, homelessness and bankruptcy, as there are no other precautions installed.

Germany does not have an EBT (electronic benefits transfer) card system in place and, instead, disburses welfare in cash or via direct deposit into the recipient's bank account.

As of 2022 a single person without children receives at most €449 per month at free disposal intended to cover living expenses, plus costs for reasonable accommodation (rent and heating).

As Type II benefits are meant to ensure a minimum subsistence level, the mechanism of sanctions has repeatedly been a subject in cases before the Federal Constitutional Court.

If the income increases the fixed amount, a tax authority must issue a certificate that explains that the individual has "interrupted the exercise of the profession", which must be done within 15 days.

[32] To receive unemployment benefits in Iceland, one must submit an application to the Directorate of Labour (Vinnumálastofnun) and meet a specific criteria set forth by the department.

[38] Currently, the legislation that ensures these benefits is The Act on Trade Unions and Industrial Disputes, which was adopted in 1938 and has been amended five times since its inception to adjust to the rise of globalization.

To qualify for Jobseekers Allowance, claimants must satisfy the "Habitual Residence Condition": they must have been legally in the state (or the Common Travel Area) for two years or have another good reason (such as lived abroad and are returning to Ireland after becoming unemployed or deported).

[51] Unemployment benefits in Italy consist mainly of cash transfers based on contributions (Assicurazione Sociale per l'Impiego, ASPI), up to the 75% of the previous wages for up to sixteen months.

An interesting feature worthy to be discussed is that the Italian system takes in consideration also the economic situation of the employers, and aims as well at relieving them from the costs of crisis.

[61] In Poland, the system is designed to prevent people from living off unemployment benefits long term, thus forcing them to work or rely on non-state means of support (family, charities).

Some are skeptical of how well the system is functioning in Turkey[67] Unemployment benefit is paid in the United Kingdom either as Jobseeker's Allowance or (for most people) as an element of Universal Credit.

Though policies vary by state, unemployment benefits generally pay eligible workers as high as US$1,015 in Massachusetts to a low as US$235 per week maximum in Mississippi.

[84] A similar point is made by Mazur who analyzed the welfare and inequality effects of a policy reform giving entitlement for unemployment insurance to quitters.

[85] Arash Nekoei and Andrea Weber present empirical evidence from Austria that extending unemployment benefit duration raises wages by improving reemployment firm quality.

The Labour Department estimates by the fourth quarter of 2013, as many as 40 states may need to borrow more than $90 billion to fund their unemployment programs and it will take a decade or more to pay off the debt.

[88] Possible policy options for states to shore up the unemployment insurance funds include lowering benefits for recipients and/or raising taxes on businesses.