Pictet Group

[1] It has a network of 30 offices in financial services centres, including registered banks in Geneva, Luxembourg, Nassau, Hong Kong, and Singapore.

According to its 2023 Annual Review, Pictet had CHF 633 billion of assets under management or custody, with its total capital ratio significantly exceeding the levels demanded by Swiss regulators.

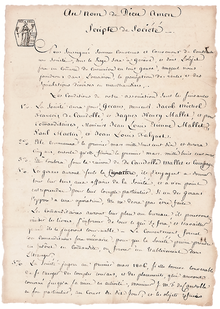

[2] Pictet traces its origin to the foundation of Banque De Candolle Mallet & Cie in Geneva on 23 July 1805.

[11] This enabled the company to manage its businesses in an international environment,[12] and also allowed the eight partners who are owner-managers of Pictet to preserve the rules of succession, which have remained unchanged for more than 200 years.

[13] Pictet operates by assigning business activities and key functions like human resources, risk control, and legal affairs to different partners.

Small committees supervise the various corporate activities so that no single partner is solely responsible for an entire area.

[15] On 4 December 2023, Pictet concluded a final settlement agreement with the DOJ to resolve a legacy investigation relating to services provided by its private banking business to US taxpayer clients between 2008 and 2014.

It provides clients with active and quantitative support for managing equities, fixed income, multi-asset and alternative strategies.

It has also taken a thematic approach, focusing on environmental themes or sectors such as clean energy and timber that are key to the concept of sustainability.

[22] In December 2023, Pictet agreed to pay $123 million to US authorities after admitting to helping clients illegally shield assets from tax in secret accounts from 2008 to 2014.