Rare disaster

Empirical methods Prescriptive and policy In economics, a rare disaster is a collapse that is infrequent and large in magnitude, having a negative effect on an economy.

Rare disasters are important because they provide an explanation of the equity premium puzzle, the behavior of interest rates, and other economic phenomena.

Examples include financial disasters: the Great Depression and the 1997 Asian financial crisis; wars: World War I, World War II, and regional conflicts; epidemics: influenza outbreaks and the Asian Flu; weather events; and earthquakes and tsunamis; however, any event that has a substantial impact on GDP and consumption could be considered a rare disaster.

The economy is closed, the number of trees is fixed, output equals consumption ( A t + 1 = C t ) and there is no investment or depreciation.

[2] In order to model rare disasters, Barro introduces the equation below, which is a stochastic process for aggregate output growth.

Since Rietz and Barro, the rare disaster framework can be used to explain many events in finance and economics.

Much of the equity premium puzzle can be explained by the rare disaster scenarios proposed by Barro and Rietz.

The basic reasoning is that if people are aware that rare disasters (i.e. the Great Depression or World War I and World War II) may occur, but the disaster never occurs during their lives, then the equity premium will appear high.

Using this evidence, Barro shows that rare disasters occur frequently and in large magnitude, in economies around the world from a period from the mid-19th century to the present day.

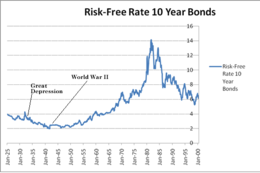

[2] Furthermore, Barro defends the criticisms about the behavior of the risk free rate raised by Mehra with respect to the Great Depression and events such as dropping the Atom Bomb in World War II.

[3] The theory was forgotten until 2005, when Robert Barro provided evidence of nations from around the world from the 19th and 20th century, showing that these events were possible and have happened.

[4] However, many economists remain skeptical of how much rare disasters really explain the equity premium and Mehra still expresses doubt as to the validity of the theory.

[5] Rajnish Mehra was skeptical of Reitz's claim that rare disasters explain the equity premium and real interest rate behavior, because the rare disaster that Rietz had specified had never occurred in the U.S. Rietz suggested 25 to 97% drops, but this has never happened in the United States.

The model Rietz presented did not compensate for a partial default on bond holders due to rapid inflation.

For example, the perceived probability of a rare disaster should have been low before the atomic bomb was dropped and must have been higher before the Cuban Missile Crisis than after.