Real interest rate

Hence the expected after-tax real return to the investor, using the simplified approximate Fisher equation above, is given by The inflation rate will not be known in advance.

The complexity increases for bonds issued for a long-term, where the average inflation rate over the term of the loan may be subject to a great deal of uncertainty.

(E.g., the three-month indexation lag of TIPS can result in a divergence of as much as 0.042% from the real interest rate, according to research by Grishchenko and Huang.

The real interest rate on short term loans is strongly influenced by the monetary policy of central banks.

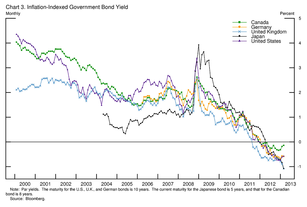

Real interest rates have been low by historical standards since 2000, due to a combination of factors, including relatively weak demand for loans by corporations, plus strong savings in newly industrializing countries in Asia.

The latter has offset the large borrowing demands by the US Federal Government, which might otherwise have put more upward pressure on real interest rates.

Lower real interest rates would make it profitable to borrow to finance the purchasing of a greater number of machines.

Conversely, when the real rate of interest is low, income usage will move from saving to consumption, and physical investment will rise.

Different economic theories, beginning with the work of Knut Wicksell, have had different explanations of the effect of rising and falling real interest rates.

[5] Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk.

[6][7] Lawrence Summers stated that at such low rates, government debt borrowing saves taxpayer money, and improves creditworthiness.