Reliance Industries

Its businesses include energy, petrochemicals, natural gas, retail, entertainment, telecommunications, mass media, and textiles.

[9] The company has attracted controversy for reports of political corruption, cronyism, fraud, financial manipulation, and exploitation of its customers, Indian citizens, and natural resources.

[22] In 1995/96, the company entered the telecommunications industry through a joint venture with NYNEX, USA, and promoted Reliance Telecom Private Limited in India.

The in-place volume of natural gas was more than 7 trillion cubic feet, equivalent to about 120 crore (1.2 billion) barrels of crude oil.

BP took a 30 per cent stake in 23 oil and gas production sharing contracts that Reliance operates in India, including the KG-D6 block for $7.2 billion.

[38] In August 2019, Reliance added Fynd[39] primarily for its consumer businesses and mobile phone services in the e-commerce space.

[42] In February 2024, Reliance Industries Ltd. and The BharatGPT group announced that it will launch large language model (LLM), Hanuman's AI system in March 2024.

[53][non-primary source needed][54][55] On 28 December 2017, RIL announced that it will be acquiring the wireless assets of Anil Ambani-led Reliance Communications for about ₹23,000 crores.

[57][non-primary source needed] In July 2012, RIL informed that it was going to invest US$1 billion over the next few years in its new aerospace division which will design, develop and manufacture equipment and components, including aircraft, engine, radars, avionics and accessories for military and civilian aircraft, helicopters, unmanned airborne vehicles, and aerostats.

[64][non-primary source needed] Further in May 2020, RIL sold roughly 1.15% stake in Jio Platforms for ₹5,656 crore (US$650 million) to the American private equity investor, Silver Lake Partners.

The company is also engaged in related activities involving leasing and providing services connected with computer software and data processing.

[citation needed] In March 2017, Reliance Industries Ltd (RIL) completed the sale process of its 76% equity stake in Mauritius-based oil retailer Gulf Africa Petroleum Corp (GAPCO) to Total Marketing & Services, a subsidiary of the French oil and gas firm Total SE.

[102] The East West Pipeline has been acquired by India Infrastructure Trust, which is owned by Brookfield Asset Management for a consideration of ₹13,000 crore.

[103] The company has attracted controversy for reports of political corruption, cronyism, fraud, financial manipulation, and exploitation of its customers, Indian citizens, and natural resources.

[106] In May 2014, ONGC moved to Delhi High Court accusing RIL of pilferage of 18 billion cubic metres of gas from its gas-producing block in the Krishna Godavari basin.

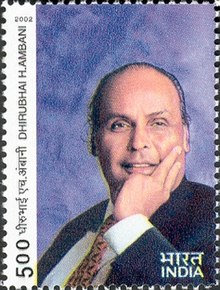

[108] Seminar magazine (2003) detailed Reliance founder Dhirubhai Ambani's proximity to politicians, his enmity with Bombay Dyeing's Nusli Wadia, the exposes by the Indian Express and Arun Shourie about illegal imports by the company and overseas share transactions by shell companies, and the botched attempt to acquire Larsen & Toubro.

[109] As early as 1996, Outlook magazine addressed other controversies related to fake and switched shares; insider trading; and a nexus with the state-owned Unit Trust of India.

Five main allegations concerning Reliance, which have plunged the Indian capital markets into a period of uncertainty unsurpassed since the days of the securities scam were: The Central Bureau of Investigation (CBI) filed a charge sheet in a Mumbai court against Reliance Industries Limited (RIL) and four retired employees of National Insurance Company Limited (NICL), including a former CMD, under provisions of the Prevention of Corruption Act for criminal conspiracy and other charges.

Acting on a reference from CVC in March 2005, the CBI started probing the conspiracy that led to the filing of the charge sheet on 9 December 2011.

[12] Two retired senior officials of National Insurance Company Limited and 11 others were awarded varying jail terms by a Delhi court in Jan 2014.

[110] A business jet owned by Reliance Industries (RIL) was grounded by The Directorate General of Civil Aviation (DGCA) on 22 March 2014 during a surprise inspection, for carrying expired safety equipment on board; its pilot was also suspended for flying without a license.

[111] Reliance Industries Limited (RIL) was supposed to relinquish 25% of the total area outside the discoveries in 2004 and 2005, as per the Production Sharing Contract (PSC).

[13][112] A PIL filed in the Supreme Court by an NGO Centre for Public Interest Litigation, through Prashant Bhushan, challenged the grant of a pan-India license to RJIL by the Government of India.

[113][114] The CAG in its draft report alleged rigging of the auction mechanism, whereby an unknown ISP, Infotech Broadband Services Pvt Ltd, acquired the spectrum by bidding 5000 times its net worth, after which the company was sold to Reliance Industries.

Reliance's possessions came after rounds of legal wrangling, including a 2020 arbitration in Singapore and an antitrust review by the Competition Commission of India.

In accordance with Securities and Exchange Board of India directive, RIL carried out an organised operation with the help of its agents in order to obtain unauthorised profits from the trading of its formerly listed unit, RPL, which was combined with the former in 2009.

The company has engaged in energy deals with Russian oil giant Rosneft, raising concerns about its alignment with global efforts to reduce economic ties with Russia.

In 2005, after a bitter public feud between the brothers over the control of the Reliance empire, mother Kokilaben intervened to broker a deal splitting the RIL group business into two parts.

Younger brother Anil Ambani received telecom, power, entertainment, and financial services business of the group.