Repurchase agreement

The dealer sells the underlying security to investors and, by agreement between the two parties, buys them back shortly afterwards, usually the following day, at a slightly higher price.

[1][2] In 2007–2008, a run on the repo market, in which funding for investment banks was either unavailable or at very high interest rates, was a key aspect of the subprime mortgage crisis that led to the Great Recession.

However, a key aspect of repos is that they are legally recognised as a single transaction (important in the event of counterparty insolvency) and not as a disposal and a repurchase for tax purposes.

By structuring the transaction as a sale, a repo provides significant protections to lenders from the normal operation of U.S. bankruptcy laws, such as the automatic stay and avoidance provisions.

The agreement might instead provide that the buyer receives the coupon, with the cash payable on repurchase being adjusted to compensate, though this is more typical of sell/buybacks.

Whereas a repo facility is a security-buying party acting as a lender of cash to security sellers who effectively borrow cash at interest (the repo rate), with the security they sell serving as collateral, a reverse repo facility is a security-selling party allowing buyers with cash to effectively lend it to the facility at interest with the security they purchase serving as collateral.

[6] In a tri-party repo, a third party facilitates elements of the transaction, typically custody, escrow, monitoring, and other services.

[3] The following table summarizes the terminology: In the United States, repos have been used from as early as 1917 when wartime taxes made older forms of lending less attractive.

[7] According to Yale economist Gary Gorton, repo evolved to provide large non-depository financial institutions with a method of secured lending analogous to the depository insurance provided by the government in traditional banking, with the collateral acting as the guarantee for the investor.

[3] In 1982, the failure of Drysdale Government Securities led to a loss of $285 million for Chase Manhattan Bank.

In the same year, the failure of Lombard-Wall, Inc. resulted in a change in the federal bankruptcy laws pertaining to repos.

[10] In 2007–2008, a run on the repo market, in which funding for investment banks was either unavailable or at very high interest rates, was a key aspect of the subprime mortgage crisis that led to the Great Recession.

[3] In July 2011, concerns arose among bankers and the financial press that if the 2011 U.S. debt ceiling crisis led to a default, it could cause considerable disruption to the repo market.

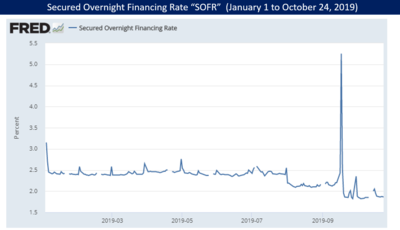

[1] The New York Times reported in September 2019 that an estimated $1 trillion per day in collateral value is transacted in the U.S. repo markets.

The term repo has given rise to a lot of misunderstanding: there are two types of transactions with identical cash flows: The sole difference is that in (i) the asset is sold (and later re-purchased), whereas in (ii) the asset is instead pledged as a collateral for a loan: in the sell-and-buy-back transaction, the ownership and possession of S are transferred at tN from a A to B and in tF transferred back from B to A; conversely, in the collateralized borrowing, only the possession is temporarily transferred to B whereas the ownership remains with A.

Alternatively it has no maturity date – but one or both parties have the option to terminate the transaction within a pre-agreed time frame.

In a tri-party repo transaction, a third party clearing agent or bank is interposed between the "seller" and the "buyer".

The third party maintains control of the securities that are the subject of the agreement and processes the payments from the "seller" to the "buyer."

Due to the high risk to the cash lender, these are generally only transacted with large, financially stable institutions.

[13] As tri-party agents administer the equivalent of hundreds of billions of USD of global collateral, they have the scale to subscribe to multiple data feeds to maximise the universe of coverage.

[14] Collateral eligibility criteria could include asset type, issuer, currency, domicile, credit rating, maturity, index, issue size, average daily traded volume, etc.

On the settlement date of the repo, the buyer acquires the relevant security on the open market and delivers it to the seller.

In case of inflation, the RBI may increase the repo rate, thus discouraging banks to borrow and reducing the money supply in the economy.

New York attorney general Andrew Cuomo alleged that this practice was fraudulent and happened under the watch of accounting firm Ernst & Young.

Charges have been filed against E&Y, with the allegations stating that the firm approved the practice of using repos for "the surreptitious removal of tens of billions of dollars of securities from Lehman’s balance sheet in order to create a false impression of Lehman’s liquidity, thereby defrauding the investing public".

[19] In the Lehman Brothers case, repos were used as Tobashi schemes to temporarily conceal significant losses by intentionally timed, half-completed trades during the reporting season.

This mis-use of repos is similar to the swaps by Goldman Sachs in the "Greek Debt Mask"[20] which were used as a Tobashi scheme to legally circumvent the Maastricht Treaty deficit rules for active European Union members and allowed Greece to "hide" more than 2.3 billion Euros of debt.

Though it is essentially a collateralized transaction, the seller may fail to repurchase the securities sold, at the maturity date.

Certain forms of repo transactions came into focus within the financial press due to the technicalities of settlements following the collapse of Refco in 2005.

In 2011, it was suggested that repos used to finance risky trades in sovereign European bonds may have been the mechanism by which MF Global put at risk some several hundred million dollars of client funds, before its bankruptcy in October 2011.