Retirement

Empirical methods Prescriptive and policy Retirement is the withdrawal from one's position or occupation or from one's active working life.

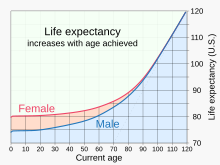

Previously, low life expectancy, lack of social security and the absence of pension arrangements meant that most workers continued to work until their death.

[3] Nowadays, most developed countries have systems to provide pensions on retirement in old age, funded by employers or the state.

Today, retirement with a pension is considered a right of the worker in many societies; hard ideological, social, cultural and political battles have been fought over whether this is a right.

An increasing number of individuals are choosing to put off this point of total retirement, by selecting to exist in the emerging state of pre-tirement.

[5][6][7][8] In consequence, only a small percentage of the population reached an age where physical impairments began to be obstacles to working.

[11] The table below shows the variation in eligibility ages for public old-age benefits in the United States and many European countries, according to the OECD.

1 In Denmark, early retirement is called efterløn and there are some requirements to be met such as contributing to the labor market for at least 20 years.

Iranian age of retirement was increased much in 2022 and 2023 to 42 years of work insurance payment record to avoid government social security bankruptcy.

[20] Recent advances in data collection have vastly improved the ability to understand important relationships between retirement and factors such as health, wealth, employment characteristics and family dynamics, among others.

The HRS is a nationally representative longitudinal survey of adults in the U.S. ages 51+, conducted every two years, and contains a wealth of information on such topics as labor force participation (e.g., current employment, job history, retirement plans, industry/occupation, pensions, disability), health (e.g., health status and history, health and life insurance, cognition), financial variables (e.g., assets and income, housing, net worth, wills, consumption and savings), family characteristics (e.g., family structure, transfers, parent/child/grandchild/sibling information) and a host of other topics (e.g., expectations, expenses, internet use, risk taking, psychosocial, time use).

These data sets have expanded the ability of researchers to examine questions about retirement behavior by adding a cross-national perspective.

[24] Nevertheless, a large literature has found that individuals respond significantly to financial incentives relating to retirement (e.g., to discontinuities stemming from the Social Security earnings test or the tax system).

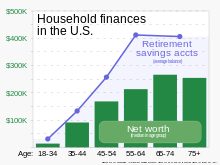

[25][26][27] Greater wealth tends to lead to earlier retirement since wealthier individuals can essentially "purchase" additional leisure.

However, many economists have found creative ways to estimate wealth effects on retirement and typically find that they are small.

For example, one paper exploits the receipt of an inheritance to measure the effect of wealth shocks on retirement using data from the HRS.

[32] Health conditions that can cause someone to retire include hypertension, diabetes mellitus, sleep apnea, joint diseases, and hyperlipidemia.

[54] In some countries an additional lump sum is granted, according to the years of work and the average pay; this is usually provided by the employer.

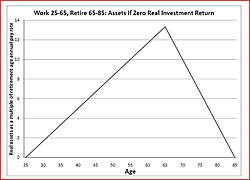

This shows a straightforward case, which nonetheless could be practically useful for optimistic people hoping to work for only as long as they are likely to be retired.

Many individuals use "retirement calculators" on the Internet to determine the proportion of their pay they should be saving in a tax advantaged-plan (e.g., IRA or 401-K in the US, RRSP in Canada, personal pension in the UK, superannuation in Australia).

After expenses and any taxes, a reasonable (though arguably pessimistic) long-term assumption for a safe real rate of return is zero.

Similarly, someone wishing to work from age 25 to 55 and be retired for 30 years till 85 needs to save 50% of pay if government and employment pensions are not a factor and if it is considered appropriate to assume a zero real investment return.

Equation (Ret-03) is readily coded in Excel and with these assumptions gives the required savings rates in the accompanying picture.

Retirement is generally considered to be "early" if it occurs before the age (or tenure) needed for eligibility for support and funds from government or employer-provided sources.

Early retirees typically rely on their own savings and investments to be self-supporting, either indefinitely or until they begin receiving external support.

The history of the US stock market shows that one would need to live on about 4% of the initial portfolio per year to ensure that the portfolio is not depleted before the end of the retirement;[62] this rule of thumb is a summary of one conclusion of the Trinity study, though the report is more nuanced and the conclusions and very approach have been heavily criticized (see Trinity study for details).

Although the 4% initial portfolio withdrawal rate described above can be used as a rough gauge, it is often desirable to use a retirement planning tool that accepts detailed input and can render a result that has more precision.

America is facing an important demographic change in that the Baby Boomer generation is now reaching retirement age.

Research around what retirees would ideally like to have a fulfilling life after retiring, found the most important factors were "physical comfort, social integration, contribution, security, autonomy and enjoyment".

[71] Many people in the later years of their lives, due to failing health, require assistance, sometimes in extremely expensive treatments – in some countries – being provided in a nursing home.