Option (finance)

Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction.

Options may be traded between private parties in over-the-counter (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts.

Selling or exercising an option before expiry typically requires a buyer to pick the contract up at the agreed upon price.

The issuer has the corresponding obligation to fulfill the transaction (to sell or buy) if the holder "exercises" the option.

When spring came and the olive harvest was larger than expected, he exercised his options and then rented the presses out at a much higher price than he paid for his 'option'.

"[4] In London, puts and "refusals" (calls) first became well-known trading instruments in the 1690s during the reign of William and Mary.

[5] Privileges were options sold over the counter in nineteenth-century America, with both puts and calls on shares offered by specialized dealers.

[citation needed] In the motion picture industry, film or theatrical producers often buy an option giving the right – but not the obligation – to dramatize a specific book or script.

The Chicago Board Options Exchange was established in 1973, which set up a regime using standardized forms and terms and trade through a guaranteed clearing house.

In contrast, other over-the-counter options are written as bilateral, customized contracts between a single buyer and seller, one or both of which may be a dealer or market-maker.

In addition, OTC option transactions generally do not need to be advertised to the market and face little or no regulatory requirements.

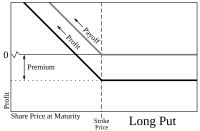

The maximum profit of a protective put is theoretically unlimited as the strategy involves being long on the underlying stock.

[19] At the same time, the model generates hedge parameters necessary for effective risk management of option holdings.

While the ideas behind the Black–Scholes model were ground-breaking and eventually led to Scholes and Merton receiving the Swedish Central Bank's associated Prize for Achievement in Economics (a.k.a., the Nobel Prize in Economics),[20] the application of the model in actual options trading is clumsy because of the assumptions of continuous trading, constant volatility, and a constant interest rate.

Nevertheless, the Black–Scholes model is still one of the most important methods and foundations for the existing financial market in which the result is within the reasonable range.

The concept was developed when Bruno Dupire[23] and Emanuel Derman and Iraj Kani[24] noted that there is a unique diffusion process consistent with the risk neutral densities derived from the market prices of European options.

For some purposes, e.g., valuation of mortgage-backed securities, this can be a big simplification; regardless, the framework is often preferred for models of higher dimension.

Closely following the derivation of Black and Scholes, John Cox, Stephen Ross and Mark Rubinstein developed the original version of the binomial options pricing model.

For a more general discussion, as well as for application to commodities, interest rates and hybrid instruments, see Lattice model (finance).

Rather than attempt to solve the differential equations of motion that describe the option's value in relation to the underlying security's price, a Monte Carlo model uses simulation to generate random price paths of the underlying asset, each of which results in a payoff for the option.

[28] Note though, that despite its flexibility, using simulation for American styled options is somewhat more complex than for lattice based models.

A trinomial tree option pricing model can be shown to be a simplified application of the explicit finite difference method.

Although the finite difference approach is mathematically sophisticated, it is particularly useful where changes are assumed over time in model inputs – for example dividend yield, risk-free rate, or volatility, or some combination of these – that are not tractable in closed form.

Note that for a delta neutral portfolio, whereby the trader had also sold 44 shares of XYZ stock as a hedge, the net loss under the same scenario would be ($15.86).

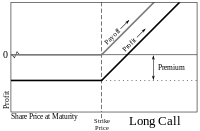

However, unlike traditional securities, the return from holding an option varies non-linearly with the value of the underlying and other factors.

To limit risk, brokers use access control systems to restrict traders from executing certain options strategies that would not be suitable for them.

Brokers may also have their own specific vetting criteria, but they are usually based on factors such as the trader's annual salary and net worth, trading experience, and investment goals (capital preservation, income, growth, or speculation).

The NASDAQ OMX PHLX allows trading of options on equities, indexes, ETFs, and foreign currencies.

Its trading platform provides a maximum price improvement auction to allow market makers to compete for orders.

It offers trading in futures and options on interest rates, equities, indexes, and fixed-income products.