Stock valuation

If the valuation of a company is lower or higher than other similar stocks, then the next step would be to determine the reasons.

The first approach, Fundamental analysis, is typically associated with investors and financial analysts - its output is used to justify stock prices.

This form of valuation often drives the short-term stock market trends; and is associated with speculators as opposed to investors.

The discounted cash flow (DCF) method involves discounting of the profits (dividends, earnings, or cash flows) that the stock will bring to the stockholder in the foreseeable future, and sometimes a final value on disposal,[2] depending on the valuation method.

[3] The discounted rate normally includes a risk premium which is commonly based on the capital asset pricing model.

In July 2010, a Delaware court ruled on appropriate inputs to use in discounted cash flow analysis in a dispute between shareholders and a company over the proper fair value of the stock.

Contested inputs included the terminal growth rate, the equity risk premium, and beta.

[4] EPS is the Net income available to common shareholders of the company divided by the number of shares outstanding.

Historical EPS figures and forecasts for the next 1–2 years can be found by visiting free financial sites such as Yahoo Finance (enter the ticker and then click on "estimates").

Historical P/Es are computed by taking the current price divided by the sum of the EPS for the last four quarters, or for the previous year.

Specifically, consider what range the P/E has traded in so as to determine whether the current P/E is high or low versus its historical average.

Discounted cash flow based valuations rely (very) heavily on the expected growth rate of a company.

However, since, companies are constantly evolving, as is the economy, solely using historical growth rates to predict the future will not be appropriate (the "problem of induction"; see Discounted cash flow #Shortcomings).

Calculating the future growth rate, therefore, requires personal investment research – familiarity with a company is essential before making a forecast.

Regardless of research effort, a growth-rate based valuation, therefore, relies heavily on experience and judgement ("gut feel"), and analysts will thus (often) make inaccurate forecasts.

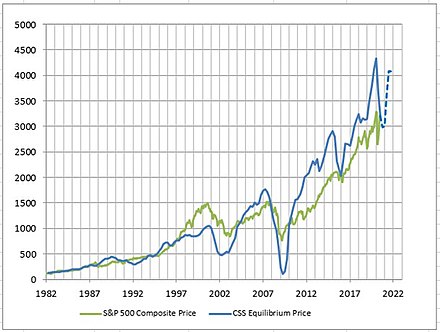

The equilibrium condition of the CSS theory can be easily rearranged to an asset pricing formula:

where The CSS theory suggests that company share prices are strongly influenced by bondholders.

The conjecture is based on a belief that P/E ratios should approximate the long-term growth rate of a company's earnings.

The PEG ratio is a special case in the sum of perpetuities method (SPM) [5] equation.

A generalized version of the Walter model (1956),[6] SPM considers the effects of dividends, earnings growth, as well as the risk profile of a firm on a stock's value.

Derived from the compound interest formula using the present value of a perpetuity equation, SPM is an alternative to the Gordon Growth Model.

[7] This valuation technique measures how much money the company makes each year per dollar of invested capital.

To compute the ratio, take the pro forma net income (same one used in the EPS figure mentioned above) and divide it by the invested capital.

Invested capital can be estimated by adding together the stockholders equity, the total long and short term debt and accounts payable, and then subtracting accounts receivable and cash (all of these numbers can be found on the company's latest quarterly balance sheet).

Similar to ROIC, ROA, expressed as a percent, measures the company's ability to make money from its assets.

To measure the ROA, take the pro forma net income divided by the total assets.

However, because of very common irregularities in balance sheets (due to things like Goodwill, write-offs, discontinuations, etc.)

To measure it, multiply the current stock price by the fully diluted shares outstanding.

However, by applying an EV to Sales ratio, one could compute what that company could trade for when its restructuring is over and its earnings are back to normal.