Tax wedge

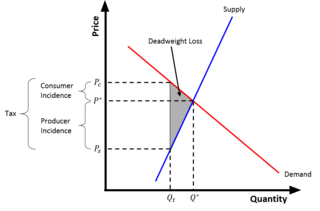

The tax wedge is the deviation from the equilibrium price and quantity (

[1] Put differently, the tax wedge is the difference between the price consumers pay and the value producers receive (net of tax) from a transaction.

Following the Law of Supply and Demand, as the price to consumers increases, and the price received by suppliers decreases, the quantity that each wishes to trade will decrease.

After a tax is introduced, a new equilibrium is reached, where consumers pay more

[2] Deadweight loss is the reduction in social efficiency (producer and consumer surplus) from preventing trades for which benefits exceed costs.

[2] Deadweight loss occurs with a tax because a higher price for consumers, and a lower price received by suppliers, reduces the quantity of the good sold.

[3] For example, if a person directly pays his or her income tax to the government[4] (with no employer withholding), the statutory burden would fall on consumers.

Put another way, economic incidence reflects the actual change in an individual's or firm's resources due to the tax.

[2] In fact, the economic incidence is completely determined by the elasticity of supply and demand.

The party with the more inelastic (steeper) curve bears more of the tax.

[2] For example, consumers of tobacco products typically bear more of the tax on tobacco, because they are addicted to the product and their consumption is not strongly affected by price changes (demand is inelastic).

[5] Producers bear more of the tax when supply is inelastic; for example, producers of beachfront hotels would bear more of a tax on hotels and accept lower prices for their product, because a change in price would not have a large effect on the quantity of beachfront hotels.

When demand is perfectly inelastic, the tax burden is fully shifted onto consumers; when supply is perfectly inelastic, the tax burden is fully shifted onto producers.

[2] In the long run, however, supply and demand both become more elastic: consumers' preferences for a product can change (cigarette smokers can quit smoking), and suppliers can choose to reduce their investment in, or leave, the market (a hotel chain can decide to sell its beachfront properties).

This means that the economic incidence on consumers and producers can change in the long run.

[2] The size and impact of the tax wedge vary considerably across countries.

European countries, especially in Scandinavia, tend to have a high tax wedge due to comprehensive social security systems and robust public services.

Countries like Belgium, Germany, and France have some of the highest tax wedges globally.