Tehran Stock Exchange

Initially limited in size and scope, the Tehran Stock Exchange (the "TSE") began operations in 1967, trading only in corporate and government bonds.

[12] The market has experienced its share of highs and lows in the past years including topping the World Federation of Exchanges' list in terms of performance in 2004.

[13] In 2014, after reaching historic highs, TSE lost a quarter of its total market capitalization because of the collapse of the Iranian rial and the slump in oil prices.

[16] The symbol of the TSE is a highly stylized representation of an Achaemedian dynasty (550-330 BC) gun-metal relief artifact, which was found in Lorestan province.

They are shown standing inside circles of the globe, which is in turn, according to ancient Iranian myth, supported on the backs of two cows, symbols of intelligence and prosperity.

[20] The Iranian Judicial chief demanded questioning from the president and a member of parliament called for firing the stock exchange organization's CEO.

[27] Under its new structure, TSE has online trading, an arbitration board, digital signature, investor protection, surveillance mechanisms as well as post-trade systems.

[4] The Tehran Stock Exchange (TSE) has started an ambitious modernization program aimed at increasing market transparency and attracting more domestic and foreign investors.

[4] This can be changed in specific situation by the Board of the TSE in case of unusual price movements resulting in an extremely high or low P/E ratio.

The introduction of project-based participation certificates that bear a fixed annual return during the period of the project and promise the final settlement of the profit at the date of its completion, has diversified the market.

[57] Also true, there are companies in Iran which suffer problems such as mismanagement, energy inefficiency, overstaffing, opaque auditing systems, obsolete marketing and distribution networks and high levels of debt.

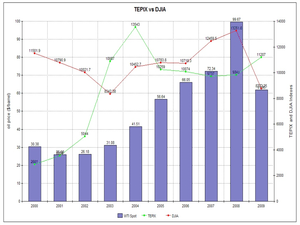

[74] While the overall indices of the world's five major exchanges – New York City, London, Paris, Frankfurt and Tokyo plunged by 40 to 70% between March 2001 and April 2003, the TSE index (Tepix) bucked the trend by going up nearly 80%.

[75][76][77] 2008: The TSE was not directly affected by the international financial turmoil in 2008, but following the global reduction in prices of copper and steel, the bourse index dropped by 12.5 percent, as most of the companies listed on the exchange are producers of such commodities.

[citation needed] 2010: In the first month of Iranian 2010 (March 20 – April 21, 2010), the index hit the 14,000 unit mark, up from the previous 12,500, showing 12 percent growth.

[citation needed] Experts commented that the growth was also partly due to a government decision to sell off 20 percent of its equity in two major automakers.

Given the relative low market valuation of TSE stocks in 2010, the upward trend was expected to continue over the long run, rather than being a bubble.

[83] On April 9, 2011, TSE's main index (TEPIX) hit a new all-time record high at 26,222 over a boost from the stocks of metal and shipping industries.

[91] 2015: The Iranian state is the biggest player in the economy, and the annual budget strongly influences the outlook of local industries and the stock market.

[95] According to the same experts, several factors contributed to this, namely better regulation, increased knowledge of the stock market and wider access by the general population and the lackluster status of competing sectors such as gold or real estate.

[97] The Central Bank of Iran indicate that 70 percent of the Iranians own homes with huge amounts of idle money entering the housing market.

[citation needed] With the removal of obstacles to foreign investment Iran could potentially have a 2,000–3,000 billion US dollar stock exchange market.

[91] According to Voltan Capital Management LLC in New York City, growth valuations and potential investment upside are similar to frontier markets in their early stage while it has developed characteristics such as well-educated workforce, a large middle-class and a broad industrial base.

Furthermore, an amendment of the article 44 of the Iranian Constitution in 2004 has allowed 80% of state assets to be privatized, 40% of which will be conducted through the "Justice Shares" scheme and the rest through the Bourse Organization.

[citation needed] Iran has announced it will begin to allow foreign firms to purchase Iranian state-run companies, with the possibility of obtaining full ownership.

[113] FIPPA provisions apply to all foreign investors, and many Iranian expatriates based in the US continue to make substantial investments in Iran.

[114] So far, the Tedpix index has been driven by domestic investors, including wealthy Iranians, public sector pension funds and the investment arms of state-owned banks.

[91] On 10 November 2018 Gottfried Leibbrandt, chief executive of SWIFT said in Belgium that some banks in Iran would be disconnected from this financial messaging service.

[citation needed] Moreover, under the law, foreign investors are protected and insured against possible losses and damages caused by future political turmoil or regional conflicts.

Iran is to target foreign investment in its energy sector by creating an umbrella group of nearly 50 state-run firms and listing its shares on four international stock exchanges.

[14][122] Turquoise Partners publishes one of the few English newsletters that covers developments of the Tehran Stock Exchange and the Iranian economy called "Iran Investment Monthly".