Monetary policy of the United States

The U.S. Congress has established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates.

Through these variables, monetary policy influences spending, investment, production, employment and inflation in the United States.

[2][3] In addition, the Fed should foster safety and efficiency in the payment and settlement system and promote consumer protection and community development.

[1] Monetary policy works by stimulating or suppressing the overall demand for goods and services in the economy, which will tend to increase respectively diminish employment and inflation.

[5] The various channels summarized above through which the Federal Reserve's actions affect the general interest rate level and consequently the overall economy are collectively referred to as the monetary transmission mechanism.

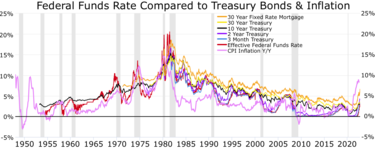

[4] In some cases, the Fed may raise the FFR to the extent that the shorter term interest rates rise sufficiently to climb above their longer maturity bonds, causing an inverted yield curve.

Open-market operations are no longer used to steer the FR, but still form part of the over-all monetary policy toolbox, as they are used to always maintain an ample supply of reserves.

Other than loans, investment activities of commercial banks and the Federal Reserve also increase and decrease the money supply.

[26] The Federal Reserve's present-day dual mandate monetary policy objectives to keep prices stable and unemployment low has replaced past practices under a gold standard where the main concern was the gold equivalent of the local currency, or under a gold exchange standard where the concern is fixing the exchange rate versus another gold-convertible currency (previously practiced worldwide under the Bretton Woods Agreement of 1944 via fixed exchange rates to the U.S. dollar).

[51][43] The vast majority of the broad money supply throughout the world represents current outstanding loans of banks to various debtors.

Also, the Federal Reserve is credited for easing tensions in the business sector with the reassurances given following the 9/11 terrorist attacks on the United States.

[57] The Federal Reserve has been the target of various criticisms, involving: accountability, effectiveness, opacity, inadequate banking regulation, and potential market distortion.

[59] The Federal Reserve is subject to different requirements for transparency and audits than other government agencies, which its supporters claim is another element of the Fed's independence.

Similar to other government agencies, the Federal Reserve maintains an Office of the Inspector General, whose mandate includes conducting and supervising "independent and objective audits, investigations, inspections, evaluations, and other reviews of Board programs and operations".

"[65] As mentioned above, it was in 1999 that the law governing the Federal Reserve was amended to formalize the already-existing annual practice of ordering independent audits of financial statements for the Federal Reserve Banks and the Board;[66] the GAO's restrictions on auditing monetary policy continued, however.

[64] Scholars have conceded that the hearings did not prove an effective means of increasing oversight of the Federal Reserve, perhaps because "Congresspersons prefer to bash an autonomous and secretive Fed for economic misfortune rather than to share the responsibility for that misfortune with a fully accountable Central Bank", although the Federal Reserve has also consistently lobbied to maintain its independence and freedom of operation.

[67] By law, the goals of the Fed's monetary policy are: high employment, sustainable growth, and stable prices.

[68] Critics say that monetary policy in the United States has not achieved consistent success in meeting the goals that have been delegated to the Federal Reserve System by Congress.

Congress began to review more options with regard to macroeconomic influence beginning in 1946 (after World War II), with the Federal Reserve receiving specific mandates in 1977 (after the country suffered a period of stagflation).

Throughout the period of the Federal Reserve following the mandates, the relative weight given to each of these goals has changed, depending on political developments.

[69] Inflation worldwide has fallen significantly since former Federal Reserve Chairman Paul Volcker began his tenure in 1979, a period which has been called the Great Moderation; some commentators attribute this to improved monetary policy worldwide, particularly in the Organisation for Economic Co-operation and Development.

There are, on the other hand, many economists who support the need for an independent central banking authority, and some have established websites that aim to clear up confusion about the economy and the Federal Reserve's operations.

Some economists, especially those belonging to the heterodox Austrian School, criticize the idea of even establishing monetary policy, believing that it distorts investment.

Briefly, the theory holds that an artificial injection of credit, from a source such as a central bank like the Federal Reserve, sends false signals to entrepreneurs to engage in long-term investments due to a favorably low interest rate.

These investments, which are more appropriately called "malinvestments", are realized to be unsustainable when the artificial credit spigot is shut off and interest rates rise.

During periods when the national debt of the United States has declined significantly (such as happened in fiscal years 1999 and 2000), monetary policy and financial markets experts have studied the practical implications of having "too little" government debt: both the Federal Reserve and financial markets use the price information, yield curve and the so-called risk free rate extensively.

[91] Experts are hopeful that other assets could take the place of National Debt as the base asset to back Federal Reserve notes, and Alan Greenspan, long the head of the Federal Reserve, has been quoted as saying, "I am confident that U.S. financial markets, which are the most innovative and efficient in the world, can readily adapt to a paydown of Treasury debt by creating private alternatives with many of the attributes that market participants value in Treasury securities.

[53][93] Leading ecological economist and steady-state theorist Herman Daly, claims that "over 95% of our [broad] money supply [in the United States] is created by the private banking system (demand deposits) and bears interest as a condition of its existence",[53] a conclusion drawn from the Federal Reserve's ultimate dependence on increased activity in fractional reserve lending when it exercises open market operations.

[citation needed] Thus, use of expansionary open market operations typically generates more debt in the private sector of society (in the form of additional bank deposits).

These are generally considered to be akin to conspiracy theories by mainstream economists and ignored in academic literature on monetary policy.