United States energy law

Every state, the federal government, and the District of Columbia collect some motor vehicle excise taxes.

[8][9] Therefore, real estate traditionally has included all rights to water, oil, gas, and other minerals underground.

is the major federal law that authorizes and governs leasing of public lands for developing deposits of hydrocarbons and other minerals.

In BP America Production Co. v. Burton, 549 U.S. 84 (2006), the Supreme Court held that a statute of limitations does not apply to government actions for contract claims for an agency to recover royalties on such leases.

Concerned that a predicted imminent shortage of petroleum would not leave enough fuel for naval vessels, President William Howard Taft established the first Naval Petroleum Reserve by withdrawing federal land over the Elk Hills Oil Field in California from being claimed and drilled by private companies.

[29] It also directs a study for the development of oil shale and tar sands resources on public lands especially in Colorado, Utah, and Wyoming.

[30] The Act further sets Federal reliability standards regulating the electrical grid (done in response to the Blackout of 2003).

[31][32][33] There was also criticism of what was not included: the bill did not include provisions for drilling in the Arctic National Wildlife Refuge (ANWR) even though some Republicans claim "access to the abundant oil reserves in ANWR would strengthen America's energy independence without harming the environment.

[37] The auto industry said federal regulators are pushing too far, too fast in their effort to raise fuel-mileage rules.

[39] On June 22, 2008, Obama proposed the repeal of the Enron loophole as a means to curb speculation on skyrocketing oil prices.

[41] President Barack Obama's first Secretary of Energy, Steven Chu,[42][43] had no prior expertise in law.

[44] In October 2009, Secretary Chu announced a new program, Arpa-e, which will fund grants authorized under the Energy Independence and Security Act of 2007.

[48] As part of the $787 billion stimulus package or "ARRA" (technically the American Recovery and Reinvestment Act of 2009),[49] US law now allows rebates for energy efficient products and for weatherization.

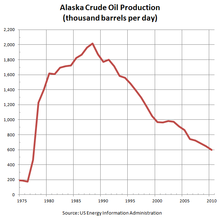

[2] Its dependence on petroleum revenues and federal subsidies allows it to have the lowest individual tax burden in the United States.

[66][67] Larry Persilly is the current coordinator; he was nominated by Barack Obama on December 9, 2009, and was confirmed by the United States Senate on March 10, 2010.

The standards are updated periodically to allow consideration and possible incorporation of new energy efficiency technologies and methods, such as the programmable communicating thermostat.

[69] California assesses an excise tax with the same basic rate of 18 cents per gallon on gasoline, diesel fuel, and gasohol.

[73] Several oil and gas companies developed uranium ore mines in New Mexico during that period.

[74] As of 2007, at least one company was evaluating development by in-situ leaching; there are potentially large deposits of coffinite and uranium oxide ores available in New Mexico.

[72][76] According to one law firm's summary of President Obama's Economic Recovery Package, the state stands to gain much from the new administration, because "New Mexico leaders and laboratories are at the forefront of energy policy.

"[77] For example, former University of New Mexico Law School professor Suedeen G. Kelly was a member of the Federal Energy Regulatory Commission.

[2] The city of Albuquerque passed an ordinance to regulate "efficiency standards for heating and cooling equipment," which was struck down by the U.S. District Court as violating the Commerce Clause of the U.S.

[81] The town board of Taos passed a "strict new new building code" in 2009 that mandated energy savings: The ordinance ... mandates that residential construction meet Home Energy Rating System standards that gradually phase in starting this year, and commercial construction must meet Leadership In Energy and Environmental Design certified standards beginning this year.The town debated the proposed Ordinance 08-16, High Performance Building Ordinance, starting in October 2008,[83] postponed it for legal review,[84] debated it in February 2009,[85] and passed it in March 2009.

Section 248 is not to be confused with Vermont's comprehensive law governing land development and subdivision – Act 250.

[107][108] Wyoming assesses an excise tax with the same rate of 14 cents per gallon on gasoline, diesel fuel, and gasohol.

[109] Florida and South Carolina have instituted utility fees to finance planned nuclear reactors.