2000s United States housing market correction

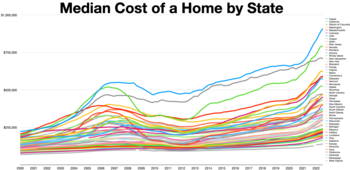

A housing bubble is characterized by rapid and sustained increases in the price of real property, such as housing' usually due to some combination of over-confidence and emotion, fraud,[2] the synthetic[3] offloading of risk using mortgage-backed securities, the ability to repackage conforming debt [4] via government-sponsored enterprises, public and central bank policy[5] availability of credit, and speculation.

Housing bubbles tend to distort valuations upward relative to historic, sustainable, and statistical norms as described by economists Karl Case and Robert Shiller in their book, Irrational Exuberance.

[19] Investor Peter Schiff acquired fame in a series of TV appearances where he opposed a multitude of financial experts and claimed that a bust was to come.

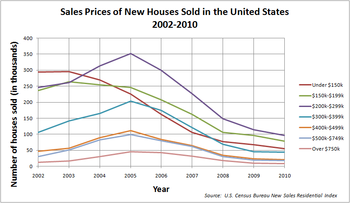

[22] National Association of Realtors (NAR) chief economist David Lereah's Explanation of "What Happened" from the 2006 NAR Leadership Conference[23] The booming housing market halted abruptly in many parts of the United States in the late summer of 2005, and as of summer 2006, several markets faced ballooning inventories, falling prices, and sharply reduced sales volumes.

In August 2006, Barron's magazine warned, "a housing crisis approaches", and noted that the median price of new homes had dropped almost 3% since January 2006, that new-home inventories hit a record in April and remained near all-time highs, that existing-home inventories were 39% higher than they were just one year earlier, and that sales were down more than 10%, and predicted that "the national median price of housing will probably fall by close to 30% in the next three years ... simple reversion to the mean.

"[13] In Boston, year-over-year prices dropped,[24] sales fell, inventory increased, foreclosures were up,[25][26] and the correction in Massachusetts was called a "hard landing" in 2005.

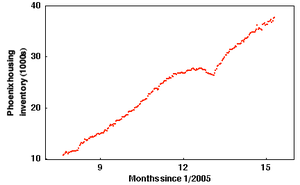

[32] The Arizona Regional Multiple Listing Service (ARMLS) showed that in summer 2006, the for-sale housing inventory in Phoenix had grown to over 50,000 homes, of which nearly half were vacant (see graphic).

[38] Six months later on 10 April 2007, Kara Homes sold unfinished developments, causing prospective buyers from the previous year to lose deposits, some of whom put down more than $100,000 (~$141,598 in 2023).

[43] The Financial Times warned of the impact on the U.S. economy of the "hard edge" in the "soft landing" scenario, saying "A slowdown in these red-hot markets is inevitable.

[52] In 2005, economist Robert Shiller gave talks warning about a housing bubble to the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation.

The only way prices can be brought back to affordable levels is a slump or recession.”[54] In January 2006, financial analyst Gary Shilling wrote an article entitled: “The Housing Bubble Will Probably Burst”.

[57] In August 2006, economist Nouriel Roubini similarly warned that the housing sector was in "free fall" and would derail the rest of the economy, causing a recession in 2007.

The manager of the world's largest bond fund PIMCO, warned in June 2007 that the subprime mortgage crisis was not an isolated event and would eventually take a toll on the economy and impact the impaired prices of homes.

[65] Bill Gross, "a most reputable financial guru", sarcastically and ominously criticized the credit ratings of the mortgage-based CDOs now facing collapse: AAA?

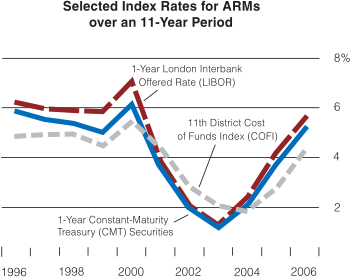

When interest rates go up, the Petri dish turns from a benign experiment in financial engineering to a destructive virus because the cost of that leverage ultimately reduces the price of assets.

[T]he point is that there are hundreds of billions of dollars of this toxic waste and whether or not they're in CDOs or Bear Stearns hedge funds matters only to the extent of the timing of the unwind.

[66]Financial analysts predicted that the subprime mortgage collapse would result in earnings reductions for large Wall Street investment banks trading in mortgage-backed securities, especially Bear Stearns, Lehman Brothers, Goldman Sachs, Merrill Lynch, and Morgan Stanley.

[69] Peter Schiff, president of Euro Pacific Capital, argued that if the bonds in the Bear Stearns funds were auctioned on the open market, much weaker values would be plainly revealed.

"[70] A New York Times report connected the hedge fund crisis with lax lending standards: "The crisis this week from the near collapse of two hedge funds managed by Bear Stearns stems directly from the slumping housing market and the fallout from loose lending practices that showered money on people with weak, or subprime, credit, leaving many of them struggling to stay in their homes.

Opponents of such proposal asserted that government bailout of subprime borrowers was not in the best interests of the U.S. economy because it would set a bad precedent, create a moral hazard, and worsen the speculation problem in the housing market.

Lou Ranieri of Salomon Brothers, inventor of the mortgage-backed securities market in the 1970s, warned of the future impact of mortgage defaults: "This is the leading edge of the storm.

Such developments are representative of the market responses that have driven the financial services industry throughout the history of our country ... With these advances in technology, lenders have taken advantage of credit-scoring models and other techniques for efficiently extending credit to a broader spectrum of consumers.

[76] In April 2007, financial problems similar to the subprime mortgages began to appear with Alt-A loans made to homeowners who were thought to be less risky.

[76] American Home Mortgage said that it would earn less and pay out a smaller dividend to its shareholders because it was being asked to buy back and write down the value of Alt-A loans made to borrowers with decent credit; causing company stocks to tumble 15.2 percent.

[66] The 30-year mortgage rates increased by more than a half a percentage point to 6.74 percent during May–June 2007,[78] affecting borrowers with the best credit just as a crackdown in subprime lending standards limits the pool of qualified buyers.

[79] A 2012 report from the University of Michigan analyzed data from the Panel Study of Income Dynamics (PSID), which surveyed roughly 9,000 representative households in 2009 and 2011.