Balances Mechanics

Statements of Balances Mechanics are not based on assumptions and preconditions of a model but are of trivial arithmetic nature, usually shaped as equation and universal without restrictions.

[1] Balances Mechanics deals with interrelations, the validity of which – contrary to most economics postulates – does not depend on assumptions about human behaviour.

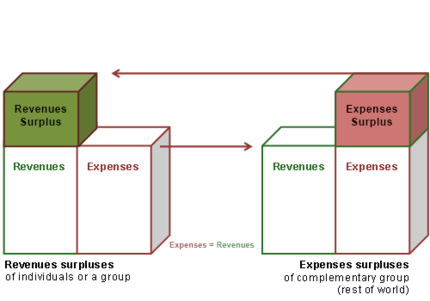

From the view of Balances Mechanics one recognizes, with regard to the counter entry, that growing expenses in overall economy mean growing revenues as well and that, for instance, at payment lock step there is no correlation at all between overall sales volume and need for medium of exchange.

Similar applies to Balances Mechanics of – strictly viewed as separated – operations of money assets and operations of medium of exchange, which can only enable a self-consistent clarification of the interrelations between money system and real economy by using a clear distinction.

This relativises common statements by classic theories which claim that so called capital collector locations would loan deposits from savers to debtors.

The complementary group to the sector of private households are all not-households (state, companies, foreign countries).

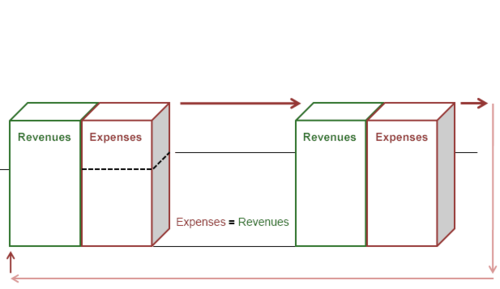

The same is valid for changes of claims and liabilities: Here the Global Sentence is: The totality of economic entities cannot rise or lower their overall net money assets.

After all the Size Mechanics shows the conditions which make the partial sentence valid that individuals and groups can change their net money assets by expense-revenue-balances: Every economic entity (individuals, private households, companies, states, national economies etc.)

The most essential application field of Balances Mechanics in economics is the analysis of changes in net financial assets.

[18] Balances Mechanics itself is no trade cycle theory, but it allows the accurate micro founding of the behaviour assumptions needed.

At buyers markets the plans for consumption and investment determine the overall expenses, and with that the overall revenues and the economic cycle.

The starting point is the balance of the individual economies' and the state's plans for building monetary assets.

This momentum is reinforced by the multiplier which results from the average willingness of the economic actors to accept unplanned changes of their money assets.

In 2002 Ewald Nowotny for instance explained: "Significant for economy politics thereby is the compulsory Balances Mechanics relationship, that a policy aiming at reducing budget deficits (funding consolidation) can only be successful when it succeeds in reducing the financial surplus of the private households (e.g. by higher private consumption) and/or in rising the debt willingness of companies (for instance, by investments) and/or in improving the trade balance (for example, by additional export).