Capital asset pricing model

CAPM assumes a particular form of utility functions (in which only first and second moments matter, that is risk is measured by variance, for example a quadratic utility) or alternatively asset returns whose probability distributions are completely described by the first two moments (for example, the normal distribution) and zero transaction costs (necessary for diversification to get rid of all idiosyncratic risk).

Under these conditions, CAPM shows that the cost of equity capital is determined only by beta.

[1][2] Despite its failing numerous empirical tests,[3] and the existence of more modern approaches to asset pricing and portfolio selection (such as arbitrage pricing theory and Merton's portfolio problem), the CAPM still remains popular due to its simplicity and utility in a variety of situations.

The CAPM was introduced by Jack Treynor (1961, 1962),[4] William F. Sharpe (1964), John Lintner (1965a,b) and Jan Mossin (1966) independently, building on the earlier work of Harry Markowitz on diversification and modern portfolio theory.

This version was more robust against empirical testing and was influential in the widespread adoption of the CAPM.

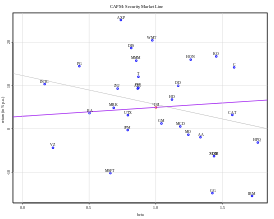

The SML enables us to calculate the reward-to-risk ratio for any security in relation to that of the overall market.

However, in empirical tests the traditional CAPM has been found to do as well as or outperform the modified beta models.

[citation needed] The SML graphs the results from the capital asset pricing model (CAPM) formula.

The equation of the SML is thus: It is a useful tool for determining if an asset being considered for a portfolio offers a reasonable expected return for its risk.

And a security plotted below the SML is overvalued since the investor would be accepting less return for the amount of risk assumed.

To make this comparison, you need an independent estimate of the return outlook for the security based on either fundamental or technical analysis techniques, including P/E, M/B etc.

Assuming that the CAPM is correct, an asset is correctly priced when its estimated price is the same as the present value of future cash flows of the asset, discounted at the rate suggested by CAPM.

using CAPM, sometimes called the certainty equivalent pricing formula, is a linear relationship given by where

Given the accepted concave utility function, the CAPM is consistent with intuition—investors (should) require a higher return for holding a more risky asset.

Stock market indices are frequently used as local proxies for the market—and in that case (by definition) have a beta of one.

Depending on the market, a portfolio of approximately 30–40 securities in developed markets such as the UK or US will render the portfolio sufficiently diversified such that risk exposure is limited to systematic risk only.

In developing markets a larger number of securities is required for diversification, due to the higher asset volatilities.

In the CAPM context, portfolio risk is represented by higher variance i.e. less predictability.

In other words, the beta of the portfolio is the defining factor in rewarding the systematic exposure taken by an investor.

All investors:[7] In their 2004 review, economists Eugene Fama and Kenneth French argue that "the failure of the CAPM in empirical tests implies that most applications of the model are invalid".