Velocity of money

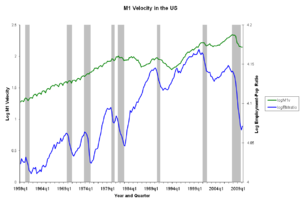

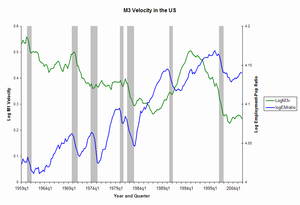

[3] The velocity of money changes over time and is influenced by a variety of factors.

[4] Because of the nature of financial transactions, the velocity of money cannot be determined empirically.

That $100 level is possible because each dollar was spent on new goods and services an average of twice a year, which is to say that the velocity was

Those favoring a quantity theory of money have tended to believe that, in the absence of inflationary or deflationary expectations, velocity will be technologically determined and stable, and that such expectations will not generally arise without a signal that overall prices have changed or will change.

This determinant has come under scrutiny in 2020-2021 as the levels of M1 and M2 Money Supply grow at an increasingly volatile rate while Velocity of M1 and M2[3] flattens to stable new low of a 1.10 ratio.

During this time, inflation has risen to new decade highs without the velocity of money.

Ludwig von Mises in a 1968 letter to Henry Hazlitt said: "The main deficiency of the velocity of circulation concept is that it does not start from the actions of individuals but looks at the problem from the angle of the whole economic system.

This concept in itself is a vicious mode of approaching the problem of prices and purchasing power.