Curbstone broker

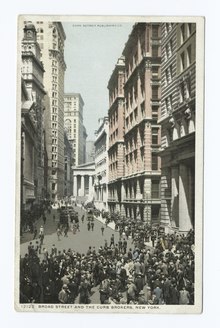

Such brokers were prevalent in the 1800s and early 1900s, and the most famous curb market existed on Broad Street in the financial district of Manhattan.

[2] Efforts to organize and standardize the market started early in the 20th century under notable curb-stone brokers such as Emanuel S.

The first local rival of the NYSE, the New Board emerged[4] among the rough and tumble conditions of the very speculative curb-side trading during the down-turn in the market in general.

By 1865, following the American Civil War, stocks in small industrial companies, such as iron and steel, textiles and chemicals were first sold by curbstone brokers.

He argued the curb exchange served "no legitimate or beneficial purpose" and was a "gambling institution, pure and simple."

On February 26, 1909, he gave a "very complete and satisfactory" testimony to the Wall Street Investigating Committee on how the curb brokers did business.

[13] On November 10, 1909, Mendels issued a notice reading that "For the protection of the public, complaints made in writing against any corporation or individual using the New York Curb market, directly or indirectly, will be investigated by the agency and referred to the proper authorities for suitable action.

The decision was made by the "Curb agent and his advisory board," who ruled via their control of the printed lists of transactions.

They held a "solemn conclave" and decided that the NYSE stocks would not be added until they had complied with the "Curb list" of requirements.

Members included E. S. Mendels, J. L. McCormack, E. M. Williams, C. H. Pforzheimer, E. A. Chartrand, T. J. Newman, W. A. Titus, Franklink Leonard Jr., H. P. Armstrong, F. T. Ackermann, W. Content, Carl Rawley, R. Godwin, A.

A second fist fight among Broad Street brokers occurred on October 7, 1916, with the police warning that the next time the two combatants would be arrested.

[17] In 1920, the New York Evening Post stated that the market presented a "motley, agitated mass of struggling, yelling, finger-wriggling humanity.

"[10] In 1920, journalist Edwin C. Hill wrote that the curb exchange on lower Broad Street was a roaring, swirling whirlpool” that "tears control of a gold-mine from an unlucky operator, then pauses to auction a puppy-dog.

It is like nothing else under the astonishing sky that is its only roof.” After a group of Curb brokers formed a real estate company to design a building, Starrett & Van Vleck designed the new exchange building on Greenwich Street in Lower Manhattan between Thames and Rector Streets, at 86 Trinity Place.

The incident occurred in the early morning, when picketers attempted to bar entrance to the NYSE building by lying on the sidewalk in front of the doors.

12 were hurt and 45 arrested in a battle between police and picketers, although the protests "failed to prevent the two security markets from operating at virtually normal rates."

[2] To get attention and be recognized on the curb in Manhattan, many members dressed in attention-grabbing clothes and used flamboyant hand signals to conduct trades.

Buyer and seller, speculator and investor, operator and spectator, agent and principal, met face to face, upon the curb and beneath the sweltering sun, opened their mouths wide and screamed all manner of seeming nonsense at each other, while their hats tipped far toward the small of their backs, their eyes strained fiercely and their arms waved wildly above their heads, from which rolled rivers of profuse perspiration.