Currency intervention

Anna Schwartz contended that the central bank can cause the sudden collapse of speculative excess, and that it can limit growth by constricting the money supply.

Objectives include: to control inflation, to achieve external balance or enhance competitiveness to boost growth, or to prevent currency crises, such as large depreciation/appreciation swings.

Then the central bank "sterilizes" the effects on the monetary base by selling (buying) a corresponding quantity of domestic-currency-denominated bonds to soak up the initial increase (decrease) of the domestic currency.

Specifically, authorities affect the exchange rate through purchasing or selling foreign money or bonds with domestic currency.

[10] A meta-analysis based on 300 different estimations on the effectiveness of the practice show that, on average, a $1 billion dollar purchase depreciates domestic currency in 1%.

[12] As we have shown in the previous example, the purchase of foreign-currency bonds leads to the increase of home-currency money supply and thus a decrease of the exchange rate.

By definition, the sterilized intervention has little or no effect on domestic interest rates, since the level of the money supply has remained constant.

On January 15, 2015, the SNB suddenly announced that it would no longer hold the Swiss Franc at the fixed exchange rate with the euro it had set in 2011.

This policy resulted in the SNB amassing roughly $480 billion-worth of foreign currency, a sum equal to about 70% of Swiss GDP.

The Economist[citation needed] asserts that the SNB dropped the cap for the following reasons: first, rising criticisms among Swiss citizens regarding the large build-up of foreign reserves.

Second, in response to the European Central Bank's decision to initiate a quantitative easing program to combat euro deflation.

[21] In June 2016, when the results of the Brexit referendum were announced, the SNB gave a rare confirmation that it had increased foreign currency purchases again, as evidenced by a rise of commercial deposits to the national bank.

During the period, the Bank of Japan, having become legally independent in March 1998, aimed at stimulating the economy by ending deflation and stabilizing the financial system.

"[25] In response of deflationary pressures, the Bank of Japan, in coordination with the Ministry of Finance, launched a reserve targeting program.

[26] By 2014, critics of Japanese currency intervention asserted that the central bank of Japan was artificially and intentionally devaluing the yen.

[citation needed] Bank of Korea Governor Kim Choong Soo has urged Asian countries to work together to defend themselves against the side-effects of Japanese Prime Minister Shinzo Abe's reflation campaign.

[citation needed] In 2013, Japanese Finance Minister Taro Aso stated Japan planned to use its foreign exchange reserves to buy bonds issued by the European Stability Mechanism and euro-area sovereigns, in order to weaken the yen.

[citation needed] The U.S. criticized Japan for undertaking unilateral sales of the yen in 2011, after Group of Seven economies jointly intervened to weaken the currency in the aftermath of the record earthquake and tsunami that year.

[28] On August 27, 2019, the Qatar Financial Centre Regulatory Authority, also known as QFCRA, fined the First Abu Dhabi Bank (FAB) for $55 million, over its failure to cooperate in a probe into possible manipulation of the Qatari riyal.

The action followed a significant amount of volatility in the exchange rates of the Qatari riyal during the first eight months of the Qatar diplomatic crisis.

[29] In December 2020, Bloomberg News reviewed a large number of emails, legal filings and documents, along with interviews conducted with the former officials and insiders of Banque Havilland.

The findings showed that the ruler used the bank for financial advice as well as for manipulating the value of the Qatari riyal in a coordinated attack aimed at deleting the country’s foreign exchange reserves.

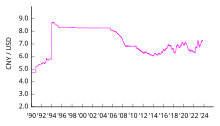

This is partly due to disagreement over the actual effects of the undervalued yuan on capital markets, trade deficits, and the US domestic economy.

[citation needed] Paul Krugman argued in 2010, that China intentionally devalued its currency to boost its exports to the United States and as a result, widening its trade deficit with the US.

By keeping its current artificially weak — a higher price of dollars in terms of yuan — China generates a dollar surplus; this means the Chinese government has to buy up the excess dollars.Greg Mankiw, on the other hand, asserted in 2010 the U.S. protectionism via tariffs will hurt the U.S. economy far more than Chinese devaluation.

[33] The view that China manipulates its currency for its own benefit in trade has been criticized by Cato Institute trade policy studies fellow Daniel Pearson,[34] National Taxpayers Union Policy and Government Affairs Manager Clark Packard,[35] entrepreneur and Forbes contributor Louis Woodhill,[36] Henry Kaufman Professor of Financial Institutions at Columbia University Charles W. Calomiris,[37] economist Ed Dolan,[38] William L. Clayton Professor of International Economic Affairs at the Fletcher School, Tufts University Michael W. Klein,[39] Harvard University Kennedy School of Government Professor Jeffrey Frankel,[40] Bloomberg columnist William Pesek,[41] Quartz reporter Gwynn Guilford,[42][43] The Wall Street Journal Digital Network Editor-In-Chief Randall W. Forsyth,[44] United Courier Services,[45] and China Learning Curve.

Earlier steps to raise interest rates by 150 basis points to 9.5 percent failed to stop the ruble's decline.

[50][51] The Russian central bank response was twofold: first, continue using Russia's large foreign currency reserve to buy rubles on the forex market in order to maintain its value through artificial demand on a larger scale.

[55][56] In March and April 2015, with the stabilization of oil prices, the ruble has made a surge, which Russian authorities have deemed a "miracle".

In response to the ruble's surge, the Russian central bank lowered its key interest rate further to 14 percent in March 2015.