Recession shapes

[2] In a V-shaped recession, the economy suffers a sharp but brief period of economic decline with a clearly defined trough, followed by a strong recovery.

Simon Johnson, former chief economist for the International Monetary Fund, says a U-shaped recession is like a bathtub: "You go in.

[7] The economy fell into recession from January 1980 to July 1980, shrinking at an 8 percent annual rate from April to June 1980.

The economy then entered a quick period of growth, and in the first three months of 1981 grew at an 8.4 percent annual rate.

As the Federal Reserve under Paul Volcker raised interest rates to fight inflation, the economy dipped back into recession (hence, the "double-dip") from July 1981 to November 1982.

Countries affected included Italy, Spain, Portugal, France, Ireland, Germany and Cyprus.

Alternative terms for long periods of underperformance include "depression" and "lost decade"; compare also "malaise".

A classic example of an L-shaped recession occurred in Japan following the bursting of the Japanese asset price bubble in 1990.

[11][12][13] In December 2020, Bloomberg News called 2020, "... a great year for Wall Street, but a bear market for humans".

[14] In January 2021, Edward Luce of the Financial Times warned that Jerome Powell's explicit use of asset bubbles in creating a K-shaped recovery, and the resultant widening of wealth inequality, could lead to political and social instability in the United States, saying: "The majority of people are suffering amid a Great Gatsby–style boom at the top".

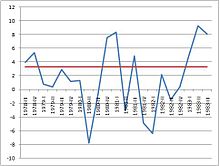

Percent Change in Real GDP (annualized; seasonally adjusted) ; Average GDP growth 1947–2009

Source: BEA

Percent Change in Real GDP (annualized; seasonally adjusted) ; Average GDP growth 1947–2009

Source: BEA

Percent Change in Real GDP (annualized; seasonally adjusted) ; Average GDP growth 1947–2009

Source: BEA

Inverted yield curve twice in a row in the late 1970s and early 1980s

Percent Change in Real GDP (annualized; seasonally adjusted) ;

Average GDP growth 1950–2000

Source: Penn World Tables