Efficient-market hypothesis

[3] The idea that financial market returns are difficult to predict goes back to Bachelier,[4] Mandelbrot,[5] and Samuelson,[6] but is closely associated with Eugene Fama, in part due to his influential 1970 review of the theoretical and empirical research.

During the 1930s-1950s empirical studies focused on time-series properties, and found that US stock prices and related financial series followed a random walk model in the short-term.

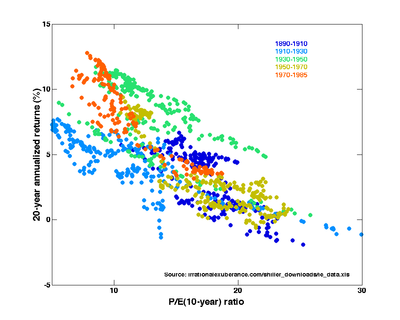

[14] While there is some predictability over the long-term, the extent to which this is due to rational time-varying risk premia as opposed to behavioral reasons is a subject of debate.

But the work was never forgotten in the mathematical community, as Bachelier published a book in 1912 detailing his ideas,[16] which was cited by mathematicians including Joseph L. Doob, William Feller[16] and Andrey Kolmogorov.

[16] The concept of market efficiency had been anticipated at the beginning of the century in the dissertation submitted by Bachelier (1900) to the Sorbonne for his PhD in mathematics.

[19] The efficient markets theory was not popular until the 1960s when the advent of computers made it possible to compare calculations and prices of hundreds of stocks more quickly and effortlessly.

[24] This is often cited in support of the efficient-market theory, by the method of affirming the consequent,[25][26] however in that same paper, Samuelson warns against such backward reasoning, saying "From a nonempirical base of axioms you never get empirical results.

The paper extended and refined the theory, included the definitions for three forms of financial market efficiency: weak, semi-strong and strong (see above).

[28] Investors, including the likes of Warren Buffett,[31] George Soros,[32][33] and researchers have disputed the efficient-market hypothesis both empirically and theoretically.

These have been researched by psychologists such as Daniel Kahneman, Amos Tversky and Paul Slovic and economist Richard Thaler.

[37] In an earlier paper, Dreman also refuted the assertion by Ray Ball that these higher returns could be attributed to higher beta leading to a failure to correctly risk-adjust returns;[38] Dreman's research had been accepted by efficient market theorists as explaining the anomaly[39] in neat accordance with modern portfolio theory.

Any manifestation of hyperbolic discounting in the pricing of these obligations would invite arbitrage thereby quickly eliminating any vestige of individual biases.

Similarly, diversification, derivative securities and other hedging strategies assuage if not eliminate potential mispricings from the severe risk-intolerance (loss aversion) of individuals underscored by behavioral finance.

On the other hand, economists, behavioral psychologists and mutual fund managers are drawn from the human population and are therefore subject to the biases that behavioralists showcase.

Any test of this proposition faces the joint hypothesis problem, where it is impossible to ever test for market efficiency, since to do so requires the use of a measuring stick against which abnormal returns are compared —one cannot know if the market is efficient if one does not know if a model correctly stipulates the required rate of return.

[citation needed] The performance of stock markets is correlated with the amount of sunshine in the city where the main exchange is located.

[42] While event studies of stock splits are consistent with the EMH,[43] other empirical analyses have found problems with the efficient-market hypothesis.

Economists Matthew Bishop and Michael Green claim that full acceptance of the hypothesis goes against the thinking of Adam Smith and John Maynard Keynes, who both believed irrational behavior had a real impact on the markets.

[52] Economist John Quiggin has claimed that "Bitcoin is perhaps the finest example of a pure bubble", and that it provides a conclusive refutation of EMH.

In his book The Reformation in Economics, economist and financial analyst Philip Pilkington has argued that the EMH is actually a tautology masquerading as a theory.

[64] Mathematician Andrew Odlyzko argued in a 2010 paper that the UK Railway Mania of the 1830s and '40s "provides a convincing demonstration of market inefficiency.

"[65] When railroads were a new and innovative technology, there was widespread public interest in trading rail-related stocks and large amounts of capital were devoted to building more rail projects than could realistically be used for shipping or passengers.

[66] Joel Tillinghast, also a fund manager at Fidelity with a long history of outperforming a benchmark, has written that the core arguments of the EMH are "more true than not" and he accepts a "sloppy" version of the theory allowing for a margin of error.

Tillinghast also asserts that even staunch EMH proponents will admit weaknesses to the theory when assets are significantly over- or under-priced, such as double or half their value according to fundamental analysis.

Schwager also cites several instances of mispricing that he contends are impossible according to a strict or strong interpretation of the EMH.

[72] Financial journalist Roger Lowenstein said "The upside of the current Great Recession is that it could drive a stake through the heart of the academic nostrum known as the efficient-market hypothesis.

"[73] Former Federal Reserve chairman Paul Volcker said "It should be clear that among the causes of the recent financial crisis was an unjustified faith in rational expectations, market efficiencies, and the techniques of modern finance.

Martin Wolf, the chief economics commentator for the Financial Times, dismissed the hypothesis as being a useless way to examine how markets function in reality.

Posner accused some of his Chicago School colleagues of being "asleep at the switch", saying that "the movement to deregulate the financial industry went too far by exaggerating the resilience—the self healing powers—of laissez-faire capitalism.

"[79] Despite this, Fama said that "poorly informed investors could theoretically lead the market astray" and that stock prices could become "somewhat irrational" as a result.