Federal funds rate

Additional tools at the Fed's disposal are: the overnight reverse repurchase agreement facility, discount rate, and open market operations.

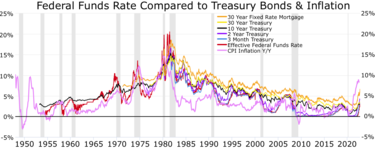

The target range is chosen to influence market interest rates generally and in turn ultimately the level of activity, employment and inflation in the U.S.

[3] Financial institutions are obligated by law to hold liquid assets that can be used to cover sustained net cash outflows.

[7] Although this is commonly referred to as "setting interest rates," the effect is not immediate and depends on the banks' response to money market conditions.

[8] Overnight Reverse Repurchase Agreement Facility is how the Fed sets rates for financial institutions which do not qualify to earn the IORB.

[8] Open Market Operations is when the Federal Reserve buys or sells government securities, thereby either adding or removing liquidity from the banking system.

For example, a bank may want to finance a major industrial effort but may not have the time to wait for deposits or interest (on loan payments) to come in.

Raising the federal funds rate will dissuade banks from taking out such inter-bank loans, which in turn will make cash that much harder to procure.

Based on CME Group 30-Day Fed Fund futures prices, which have long been used to express the market's views on the likelihood of changes in U.S. monetary policy, the CME Group FedWatch tool allows market participants to view the probability of an upcoming Fed Rate hike.

[13] On March 15, 2020, the target range for Federal Funds Rate was 0.00–0.25%,[14] a full percentage point drop less than two weeks after being lowered to 1.00–1.25%.

Reducing the federal funds rate makes money cheaper, allowing an influx of credit into the economy through all types of loans.

[30] A low federal funds rate makes investments in developing countries such as China or Mexico more attractive.

The long period of a very low federal funds rate from 2009 forward resulted in an increase in investment in developing countries.