Gold as an investment

[1] Gold has been used throughout history as money and has been a relative standard for currency equivalents specific to economic regions or countries, until recent times.

Many European countries implemented gold standards in the latter part of the 19th century until these were temporarily suspended in the financial crises involving World War I.

[2] After World War II, the Bretton Woods system pegged the United States dollar to gold at a rate of US$35 per troy ounce.

[22] Such variables include the price of oil, the use of quantitative easing, currency exchange rate movements and returns on equity markets.

Jewelry and industrial demand have fluctuated over the past few years due to the steady expansion in emerging markets of middle classes aspiring to Western lifestyles, offset by the financial crisis of 2007–2010.

This happened in the USA during the Great Depression of the 1930s, leading President Roosevelt to impose a national emergency and issue Executive Order 6102 outlawing the "hoarding" of gold by US citizens.

In some countries, like Canada, Austria, Liechtenstein and Switzerland, these can easily be bought or sold at the major banks.

Larger bars also have a greater volume in which to create a partial forgery using a tungsten-filled cavity, which may not be revealed by an assay.

Bullion products from these trusted refiners are traded at face value by LBMA members without assay testing.

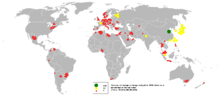

And as the past shows, there may be risk even in countries considered democratic and stable; for example in the US in the 1930s gold was seized by the government and legal moving was banned.

[33] Efforts to combat gold bar counterfeiting include kinebars which employ a unique holographic technology and are manufactured by the Argor-Heraeus refinery in Switzerland.

[citation needed] The Krugerrand is the most widely held gold bullion coin, with 46 million troy ounces (1,400 tonnes) in circulation.

As of November 2010[update], SPDR Gold Shares is the second-largest exchange-traded fund in the world by market capitalization.

For example, the most popular gold ETP (GLD) has been widely criticized, and even compared with mortgage-backed securities, due to features of its complex structure.

In addition, ETFs generally redeem Creation Units by giving investors the securities that comprise the portfolio instead of cash.

They were first issued in the 17th century when they were used by goldsmiths in England and the Netherlands for customers who kept deposits of gold bullion in their vault for safe-keeping.

One of the most important differences between accounts is whether the gold is held on an allocated (fully reserved) or unallocated (pooled) basis.

Pool accounts, such as those offered by some providers, facilitate highly liquid but unallocated claims on gold owned by the company.

Other operators, by contrast, allows clients to create a bailment on allocated (non-fungible) gold, which becomes the legal property of the buyer.

Other platforms provide a marketplace where physical gold is allocated to the buyer at the point of sale, and becomes their legal property.

Typically, bullion banks only deal in quantities of 1,000 troy ounces (31 kg) or more in either allocated or unallocated accounts.

Derivatives, such as gold forwards, futures and options, currently trade on various exchanges around the world and over-the-counter (OTC) directly in the private market.

Mines are commercial enterprises and subject to problems such as flooding, subsidence and structural failure, as well as mismanagement, negative publicity, nationalization, theft and corruption.

Furthermore, at higher prices, more ounces of gold become economically viable to mine, enabling companies to add to their production.

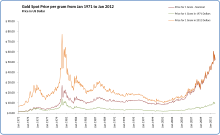

The attached graph shows the value of Dow Jones Industrial Average divided by the price of an ounce of gold.

Since 1800, stocks have consistently gained value in comparison to gold in part because of the stability of the American political system.

The Dow Industrials bottomed out a ratio of 1:1 with gold during 1980 (the end of the 1970s bear market) and proceeded to post gains throughout the 1980s and 1990s.

[51] The gold price peak of 1980 also coincided with the Soviet Union's invasion of Afghanistan and the threat of the global expansion of communism.

[52]Investors may choose to leverage their position by borrowing money against their existing assets[citation needed] and then purchasing or selling gold on account with the loaned funds.

The tax treatment of gold often reflects economic policy priorities, such as protecting domestic industry or promoting investment.