Profit and loss sharing

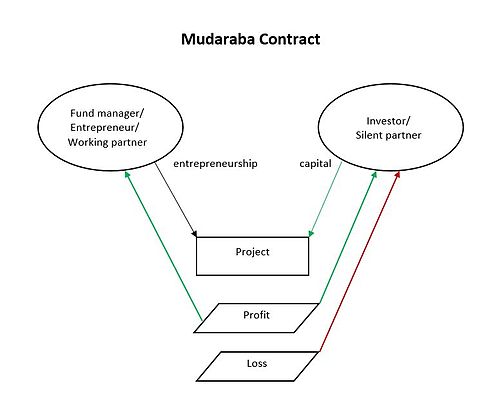

Profit and Loss Sharing (also called PLS or participatory banking) refers to Sharia-compliant forms of equity financing such as mudarabah and musharakah.

[1] Other sources include sukuk (also called "Islamic bonds")[1] and direct equity investment (such as purchase of common shares of stock) as types of PLS.

[1] The profits and losses shared in PLS are those of a business enterprise or person which/who has obtained capital from the Islamic bank/financial institution (the terms "debt", "borrow", "loan" and "lender" are not used).

[4] The intention is to promote "the concept of participation in a transaction backed by real assets, utilizing the funds at risk on a profit-and-loss-sharing basis".

[2] Profit and loss sharing is one of two categories of Islamic financing,[2] the other being debt like instruments[5] such as murabaha, istisna'a (a type of forward contract), salam and leasing, which involve the purchase and hire of assets and services on a fixed-return basis.

[6][7] The premise underlying PLS is the concept of shirkah (similar to joint venture) in which the partners share in the profit and loss based on their ownership.

[9] One of the pioneers of Islamic banking, Mohammad Najatuallah Siddiqui, suggested a two-tier model as the basis of a riba-free banking, with mudarabah being the primary mode,[4] supplemented by a number of fixed-return models – mark-up (murabaha), leasing (ijara), cash advances for the purchase of agricultural produce (salam) and cash advances for the manufacture of assets (istisna'), etc.

Such participatory arrangements between capital and labor reflect the Islamic view that the borrower must not bear all the risk/cost of a failure, resulting in a balanced distribution of income and not allowing the lender to monopolize the economy.

The borrowing and lending banks negotiate the PLS ratio and contracts may be as short as overnight and as long as one year.

One critic (Ibrahim Warde) has dubbed this 'Islamic moral hazard' in which the banks are able 'to privatise the profits and socialize the losses'.

[24] The two (or more) parties that contribute capital to a business divide the net profit and loss on a pro rata basis.

In the case of real estate or property, the bank assesses an imputed rent and will share it as agreed in advance.

If default occurs, both the bank and the borrower receive a proportion of the proceeds from the sale of the property based on each party's current equity.

[43] According to Takao Moriguchi, musharakah mutanaqisa is fairly common in Malaysia, but questions about its shariah compliance mean it is "not so prevailing in Gulf Cooperation Council (GCC) countries such as Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman".

[6][5] Another source (Suliman Hamdan Albalawi, publishing in 2006) found that PLS techniques were no longer "a core principle of Islamic banking" in Saudi Arabia and Egypt.

[58] Faleel Jamaldeen describes the decline in the use of PLS as a natural growing process, where profit and loss sharing was replaced by other contracts because PLS modes "were no longer sufficient to meet industry demands for project financing, home financing, liquidity management and other products".

[60] In the words of Al-Azhar rector Muhammad Sayyid Tantawy, "Silent partnerships [mudarabah] follow the conditions stipulated by the partners.

[5][62] (For example, one way a bank can under report its earnings is by depreciating assets at a higher level than actual wear and tear.

[7] Higher levels of corruption and a larger unofficial/underground economy where revenues are not reported, indicate poorer and harder-to-find credit information for financiers/investors.

"Profit is accrued to the bank daily on its net contribution using the Karachi Interbank Offered Rate plus a bank-set margin as the pricing basis".

[83] However according to critic Feisal Khan, this is an Islamic partnership in name only and no different than a "conventional line of credit on a daily product basis".

[87] Referring to the higher costs of Islamic finance, one banker (David Loundy) quotes an unnamed mortgage broker as stating, "The price for getting into heaven is about 50 basis points".