Modern monetary theory

MMT argues that the primary risk once the economy reaches full employment is inflation, which acts as the only constraint on spending.

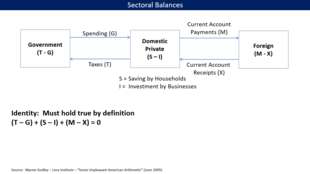

[13][14][15][16][17] MMT synthesizes ideas from the state theory of money of Georg Friedrich Knapp (also known as chartalism) and the credit theory of money of Alfred Mitchell-Innes, the functional finance proposals of Abba Lerner, Hyman Minsky's views on the banking system[18] and Wynne Godley's sectoral balances approach.

[19] The prevailing view of money was that it had evolved from systems of barter to become a medium of exchange because it represented a durable commodity which had some use value,[20] but proponents of MMT such as Randall Wray and Mathew Forstater said that more general statements appearing to support a chartalist view of tax-driven paper money appear in the earlier writings of many classical economists,[21] including Adam Smith, Jean-Baptiste Say, J. S. Mill, Karl Marx, and William Stanley Jevons.

Bill Mitchell, professor of economics and Director of the Centre of Full Employment and Equity (CoFEE) at the University of Newcastle in Australia, coined the term 'modern monetary theory'.

[31] In their 2008 book Full Employment Abandoned, Mitchell and Joan Muysken use the term to explain monetary systems in which national governments have a monopoly on issuing fiat currency and where a floating exchange rate frees monetary policy from the need to protect foreign exchange reserves.

[32] Some contemporary proponents, such as Wray, place MMT within post-Keynesian economics, while MMT has been proposed as an alternative or complementary theory to monetary circuit theory, both being forms of endogenous money, i.e., money created within the economy, as by government deficit spending or bank lending, rather than from outside, perhaps with gold.

[35] In 2019, MMT became a major topic of debate after U.S. Representative Alexandria Ocasio-Cortez said in January that the theory should be a larger part of the conversation.

[36] In February 2019, Macroeconomics became the first academic textbook based on the theory, published by Bill Mitchell, Randall Wray, and Martin Watts.

[40] In 2020 the Sri Lankan Central Bank, under the governor W. D. Lakshman, cited MMT as a justification for adopting unconventional monetary policy, which was continued by Ajith Nivard Cabraal.

This has been heavily criticized and widely cited as causing accelerating inflation and exacerbating the Sri Lankan economic crisis.

According to MMT advocates, "The balance sheet of the government does not include any domestic monetary instrument on its asset side; it owns no money.

All monetary instruments issued by the government are on its liability side and are created and destroyed with spending and taxing or bond offerings.

Taxation and its legal tender enable power to discharge debt and establish fiat money as currency, giving it value by creating demand for it in the form of a private tax obligation.

MMT economists regard the concept of the money multiplier, where a bank is completely constrained in lending through the deposits it holds and its capital requirement, as misleading.

Effects on employment are used as evidence that a currency monopolist is overly restricting the supply of the financial assets needed to pay taxes and satisfy savings desires.

[60] MMT proponents such as Warren Mosler say that trade deficits are sustainable and beneficial to the standard of living in the short term.

[citation needed] Cheap imports may also cause the failure of local firms providing similar goods at higher prices, and hence unemployment, but MMT proponents label that consideration as a subjective value-based one, rather than an economic-based one: It is up to a nation to decide whether it values the benefit of cheaper imports more than it values employment in a particular industry.

In that case, the government can default, or attempt to shift to an export-led strategy or raise interest rates to attract foreign investment in the currency.

Proponents say that this activity can be consistent with price stability because it targets unemployment directly rather than attempting to increase private sector job creation indirectly through a much larger economic stimulus, and maintains a "buffer stock" of labor that can readily switch to the private sector when jobs become available.

[73] MMT economists say that inflation can be better controlled (than by setting interest rates) with new or increased taxes to remove extra money from the economy.

[5] MMT can be compared and contrasted with mainstream Keynesian economics in a variety of ways:[4][66][67] A 2019 survey of leading economists by the University of Chicago Booth's Initiative on Global Markets showed a unanimous rejection of assertions attributed by the survey to MMT: "Countries that borrow in their own currency should not worry about government deficits because they can always create money to finance their debt" and "Countries that borrow in their own currency can finance as much real government spending as they want by creating money".

[81] The post-Keynesian economist Thomas Palley has stated that MMT is largely a restatement of elementary Keynesian economics, but prone to "over-simplistic analysis" and understating the risks of its policy implications.

[82] Palley has disagreed with proponents of MMT who have asserted that standard Keynesian analysis does not fully capture the accounting identities and financial restraints on a government that can issue its own money.

Furthermore, Palley has asserted that MMT lacks a plausible theory of inflation, particularly in the context of full employment in the employer of last resort policy first proposed by Hyman Minsky and advocated by Bill Mitchell and other MMT theorists; of a lack of appreciation of the financial instability that could be caused by permanently zero interest rates; and of overstating the importance of government-created money.

[83] Marc Lavoie has said that whilst the neochartalist argument is "essentially correct", many of its counter-intuitive claims depend on a "confusing" and "fictitious" consolidation of government and central banking operations,[17] which is what Palley calls "the problem of fiscal–monetary conflict".

[84] Krugman accused MMT devotees as engaging in "calvinball" – a game from the comic strip Calvin and Hobbes in which the players change the rules at whim.

[17] In 2015, three MMT economists, Scott Fullwiler, Stephanie Kelton, and L. Randall Wray, addressed what they saw as the main criticisms being made.