Oil shale industry

Several other countries are currently conducting research on their oil shale reserves and production methods to improve efficiency and recovery.

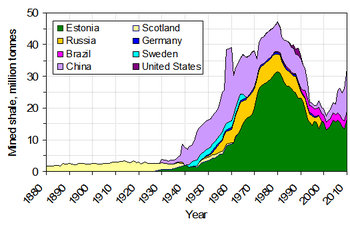

[1][4] The oil shale industry started growing just before World War I because of the mass production of automobiles and trucks and the supposed shortage of gasoline for transportation needs.

As of 2012, there are oil shale-fired power plants in Estonia with a generating capacity of 2,967 megawatts (MW), China, and Germany.

[16][17] Also Israel, Romania and Russia have run oil shale-fired power plants, but have shut them down or switched to other fuels like natural gas.

The traditional method is Pulverized combustion (PC) which is used in the older units of oil shale-fired power plants in Estonia, while the more advanced method is Fluidized bed combustion (FBC), which is used in the Holcim cement factory in Dotternhausen, Germany, and was used in the Mishor Rotem power plant in Israel.

In comparison, production of the conventional oil and natural gas liquids in 2008 amounted 3.95 billion tonnes or 82.12 million barrels per day (13.056×10^6 m3/d).

The in-situ method converts the kerogen while it is still in the form of an oil shale deposit, and then extracts it via a well, where it rises up as normal petroleum.

After World War II, Estonian-produced oil shale gas was used in Leningrad and the cities in North Estonia.

[32] According to a survey conducted by the RAND Corporation, the cost of producing a barrel of shale oil at a hypothetical surface retorting complex in the United States (comprising a mine, retorting plant, upgrading plant, supporting utilities, and spent shale reclamation), would range between US$70–95 ($440–600/m3), adjusted to 2005 values.

[36][37][38][39][40] Some modified technologies propose combining a fluidized bed retort with a circulated fluidized bed furnace for burning the by-products of pyrolysis (char and oil shale gas) and thereby improving oil yield, increasing throughput, and decreasing retorting time.

[41] In a 1972 publication by the journal Pétrole Informations (ISSN 0755-561X), shale oil production was unfavorably compared to the coal liquefaction.

[43] These include acid drainage induced by the sudden rapid exposure and subsequent oxidation of formerly buried materials, the introduction of metals including mercury[44] into surface-water and groundwater, increased erosion, sulfur-gas emissions, and air pollution caused by the production of particulates during processing, transport, and support activities.

In addition, the atmospheric emissions from oil shale processing and combustion include carbon dioxide, a greenhouse gas.

Environmentalists oppose production and usage of oil shale, as it creates even more greenhouse gases than conventional fossil fuels.

[48] Experimental in situ conversion processes and carbon capture and storage technologies may reduce some of these concerns in the future, but at the same time they may cause other problems, including groundwater pollution.

[12][52][53][54] A 2008 programmatic environmental impact statement issued by the US Bureau of Land Management stated that surface mining and retort operations produce 2 to 10 U.S. gallons (7.6 to 37.9 L; 1.7 to 8.3 imp gal) of waste water per 1 short ton (0.91 t) of processed oil shale.

[55] Environmental activists, including members of Greenpeace, have organized strong protests against the oil shale industry.

In one result, Queensland Energy Resources put the proposed Stuart Oil Shale Project in Australia on hold in 2004.