Profit maximization

Instead, they take more practical approach by examining how small changes in production influence revenues and costs.

In other words, in this case, it is in the "rational" interest of the firm to increase its output level until its total profit is maximized.

In this case, a "rational" firm has an incentive to reduce its output level until its total profit is maximized.

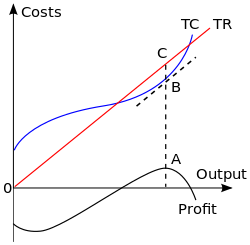

First, since profit equals revenue minus cost, one can plot graphically each of the variables revenue and cost as functions of the level of output and find the output level that maximizes the difference (or this can be done with a table of values instead of a graph).

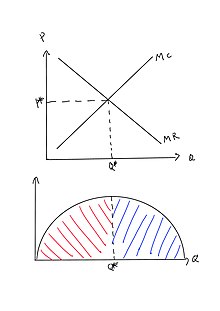

For a firm in a perfectly competitive market for its output, the revenue function will simply equal the market price times the quantity produced and sold, whereas for a monopolist, which chooses its level of output simultaneously with its selling price.

To get the most profit, you need to set higher prices and lower quantities than the competitive market.

However, the revenue function takes into account the fact that higher levels of output require a lower price in order to be sold.

These may include equipment maintenance, rent, wages of employees whose numbers cannot be increased or decreased in the short run, and general upkeep.

Variable costs change with the level of output, increasing as more product is generated.

Materials consumed during production often have the largest impact on this category, which also includes the wages of employees who can be hired and laid off in the short run span of time under consideration.

Given a table of costs and revenues at each quantity, we can either compute equations or plot the data directly on a graph.

In the accompanying diagram, the linear total revenue curve represents the case in which the firm is a perfect competitor in the goods market, and thus cannot set its own selling price.

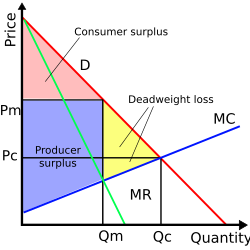

If the industry is perfectly competitive (as is assumed in the diagram), the firm faces a demand curve (

In an environment that is competitive but not perfectly so, more complicated profit maximization solutions involve the use of game theory.

In some cases a firm's demand and cost conditions are such that marginal profits are greater than zero for all levels of production up to a certain maximum.

[4] In other words, the profit-maximizing quantity and price can be determined by setting marginal revenue equal to zero, which occurs at the maximal level of output.

The marginal costs of flying one more passenger on the flight are negligible until all the seats are filled.

For example, companies may choose to earn less than the maximum profit in pursuit of higher market share.

Because price increases maximize profits in the short term, they will attract more companies to enter the market.

Many companies try to minimize costs by shifting production to foreign locations with cheap labor (e.g. Nike, Inc.).

However, moving the production line to a foreign location may cause unnecessary transportation costs.

This is stipulated under neoclassical theory, in which a firm maximizes profit in order to determine a level of output and inputs, which provides the price equals marginal cost condition.

[5][full citation needed] In the short run, a change in fixed costs has no effect on the profit maximizing output or price.

In situations where there are non-zero profits, we should expect to see either some form of long run disequilibrium or non-competitive conditions, such as barriers to entry, where there is not perfect competition between firms.

[5][full citation needed] In addition to using methods to determine a firm's optimal level of output, a firm that is not perfectly competitive can equivalently set price to maximize profit (since setting price along a given demand curve involves picking a preferred point on that curve, which is equivalent to picking a preferred quantity to produce and sell).

The profit maximization conditions can be expressed in a "more easily applicable" form or rule of thumb than the above perspectives use.

[8][full citation needed] The first step is to rewrite the expression for marginal revenue as

[10] The optimal markup rule also implies that a non-competitive firm will produce on the elastic region of its market demand curve.

[15] Some forms of producer profit maximization are considered anti-competitive practices and are regulated by competition law.

In an attempt to prevent businesses from abusing their power to maximize their own profits, governments often intervene to stop them in their tracks.