Early 1980s recession in the United States

[3] Principal causes of the 1980 recession included contractionary monetary policy undertaken by the Federal Reserve to combat double digit inflation and residual effects of the energy crisis.

[4] Manufacturing and construction failed to recover before more aggressive inflation reducing policy was adopted by the Federal Reserve in 1981, causing a second downturn.

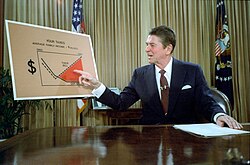

This change was primarily achieved through tax reform and stronger monetary policy on the part of the Federal Reserve, with the strong recovery and long, stable period of growth that followed increasing the popularity of both concepts in political and academic circles.

[6] This caused an economic recession beginning in January 1980, and in March 1980, president Jimmy Carter created his own plan for credit controls and budget cuts to beat inflation.

[1] As a result of the increasing federal funds rate, credit became more difficult to obtain for car and home loans.

[7] Most of the jobs lost during the recession centered around goods producing industries, while the service sector remained largely intact.

[3] The automotive industry, already in a poor position due to weak sales in 1979, shed 310,000 jobs, representing 33% of that sector.

[8] As 1981 began, the Federal Reserve reported that there would be little or no economic growth in 1981, as interest rates were to continue rising in an attempt to reduce inflation.

The mining sector shed 150,000 jobs, likely a result of high commodity prices and cratering demand from the recession.

[11] The services sector, while not hit nearly as hard as manufacturing, shed 400,000 jobs during the recession, with sharp declines in transportation, utilities, state & local governments, and wholesale and retail trade.

[2] Unemployment rose to double digits for the first time since 1941 in September 1982, and stood at a postwar high of 10.8% by the end of the year.

[15] The auto industry had posted losses of $187 million in the third quarter of 1982, which turned into a gain of $1.2 billion during the same period in 1983.

[16] To prevent a new surge of inflation, interest and mortgage rates remained abnormally high throughout 1983, delaying a recovery in construction and housing.

[20] Although the U.S. macroeconomy recovered during the 1983-1990 economic expansion period, the early-1980s recession cast a long shadow over many parts of the United States, especially those reliant on heavy industry.

For example, heavily industrialized Lake County, Indiana (home to major manufacturing cities such as Gary, East Chicago, and Hammond), did not recover its 1980 employment level until 1996.

Mining communities in Minnesota's Iron Range, Wisconsin's Driftless Area, eastern Kentucky, and West Virginia were also devastated after years of struggle.

Although inflation subsided and interest rates began to decline starting in 1983, the Federal Reserve was still committed to a strong-dollar policy through the mid-1980s.

It was not until 1985 that the Reagan administration and the Federal Reserve took action to correct this when the U.S. signed the Plaza Accord with France, West Germany, Japan, and the United Kingdom.

Inverted yield curve in late 1970s and early 1980s