Economics

[11] It is also applied to such diverse subjects as crime,[12] education,[13] the family,[14] feminism,[15] law,[16] philosophy,[17] politics, religion,[18] social institutions, war,[19] science,[20] and the environment.

[30] On the satirical side, Thomas Carlyle (1849) coined "the dismal science" as an epithet for classical economics, in this context, commonly linked to the pessimistic analysis of Malthus (1798).

[33]Lionel Robbins (1932) developed implications of what has been termed "[p]erhaps the most commonly accepted current definition of the subject":[28] Economics is the science which studies human behaviour as a relationship between ends and scarce means which have alternative uses.

From the 1960s, however, such comments abated as the economic theory of maximizing behaviour and rational-choice modelling expanded the domain of the subject to areas previously treated in other fields.

[38] Gary Becker, a contributor to the expansion of economics into new areas, described the approach he favoured as "combin[ing the] assumptions of maximizing behaviour, stable preferences, and market equilibrium, used relentlessly and unflinchingly.

"[39] One commentary characterises the remark as making economics an approach rather than a subject matter but with great specificity as to the "choice process and the type of social interaction that [such] analysis involves."

The same source reviews a range of definitions included in principles of economics textbooks and concludes that the lack of agreement need not affect the subject-matter that the texts treat.

[55] His "theorem" that "the division of labor is limited by the extent of the market" has been described as the "core of a theory of the functions of firm and industry" and a "fundamental principle of economic organization.

"[56] To Smith has also been ascribed "the most important substantive proposition in all of economics" and foundation of resource-allocation theory—that, under competition, resource owners (of labour, land, and capital) seek their most profitable uses, resulting in an equal rate of return for all uses in equilibrium (adjusted for apparent differences arising from such factors as training and unemployment).

One hundred and thirty years later, Lionel Robbins noticed that this definition no longer sufficed,[c] because many economists were making theoretical and philosophical inroads in other areas of human activity.

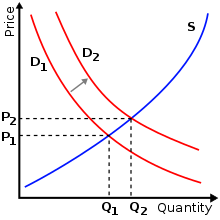

[72] Neoclassical economics systematically integrated supply and demand as joint determinants of both price and quantity in market equilibrium, influencing the allocation of output and income distribution.

[77] Keynesian economics derives from John Maynard Keynes, in particular his book The General Theory of Employment, Interest and Money (1936), which ushered in contemporary macroeconomics as a distinct field.

[81][82] Friedman was also skeptical about the ability of central banks to conduct a sensible active monetary policy in practice, advocating instead using simple rules such as a steady rate of money growth.

[86] During the 1980s, a group of researchers appeared being called New Keynesian economists, including among others George Akerlof, Janet Yellen, Gregory Mankiw and Olivier Blanchard.

They adopted the principle of rational expectations and other monetarist or new classical ideas such as building upon models employing micro foundations and optimizing behaviour, but simultaneously emphasised the importance of various market failures for the functioning of the economy, as had Keynes.

Use of commonly accepted methods need not produce a final conclusion or even a consensus on a particular question, given different tests, data sets, and prior beliefs.

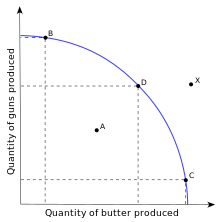

Recognizing the reality of scarcity and then figuring out how to organise society for the most efficient use of resources has been described as the "essence of economics", where the subject "makes its unique contribution.

It has been observed that a high volume of trade occurs among regions even with access to a similar technology and mix of factor inputs, including high-income countries.

This has led to investigation of economies of scale and agglomeration to explain specialisation in similar but differentiated product lines, to the overall benefit of respective trading parties or regions.

A unifying theme is the attempt to optimise business decisions, including unit-cost minimisation and profit maximisation, given the firm's objectives and constraints imposed by technology and market conditions.

[136] Applied subjects include market and legal remedies to spread or reduce risk, such as warranties, government-mandated partial insurance, restructuring or bankruptcy law, inspection, and regulation for quality and information disclosure.

Policy options include regulations that reflect cost–benefit analysis or market solutions that change incentives, such as emission fees or redefinition of property rights.

[146] Such aggregates include national income and output, the unemployment rate, and price inflation and subaggregates like total consumption and investment spending and their components.

Keynes contended that aggregate demand for goods might be insufficient during economic downturns, leading to unnecessarily high unemployment and losses of potential output.

[155] Large amounts of structural unemployment can occur when an economy is transitioning industries and workers find their previous set of skills are no longer in demand.

Money has general acceptability, relative consistency in value, divisibility, durability, portability, elasticity in supply, and longevity with mass public confidence.

[164] Via the monetary transmission mechanism, interest rate changes affect investment, consumption and net export, and hence aggregate demand, output and employment, and ultimately the development of wages and inflation.

Both tax cuts and spending have multiplier effects where the initial increase in demand from the policy percolates through the economy and generates additional economic activity.

[168] In advanced economies, taxes and transfers decrease income inequality by one-third, with most of this being achieved via public social spending (such as pensions and family benefits.

Five have received the John Bates Clark Medal: Susan Athey (2007), Esther Duflo (2010), Amy Finkelstein (2012), Emi Nakamura (2019) and Melissa Dell (2020).