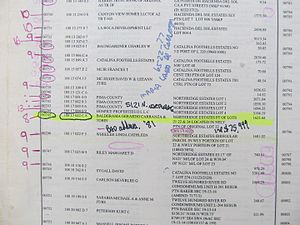

Tax lien

[4] If the taxpayer fails to pay the tax within the ten-day period, the tax lien arises automatically (i.e., by operation of law), and is effective retroactively to (i.e., arises at) the date of the assessment, even though the ten-day period necessarily expires after the assessment date.

The statute of limitations under which a federal tax lien may become "unenforceable because of lapse of time" is found at 26 U.S.C. § 6502.

A federal tax lien arising by law as described above is valid against the taxpayer without any further action by the government.

The current form of the Notice of Federal Tax Lien utilized by the IRS contains a provision that provides that the NFTL is released by its own terms at the conclusion of the statute of limitations period described above provided that the NFTL has not been refiled by the date indicated on the form.

The effect of this provision is that the NFTL operates as a Certificate of Release of Federal Tax Lien on the day after the date indicated in the form by its own terms.

The term "levy" in this narrow technical sense denotes an administrative action by the Internal Revenue Service (i.e., without going to court) to seize property to satisfy a tax liability.

[12] The general rule is that no court permission is required for the IRS to execute a section 6331 levy.

That is, certain property covered by the lien may be exempt from an administrative levy[14] (property covered by the lien that is exempt from administrative levy may, however, be taken by the IRS if the IRS obtains a court judgment).

In connection with federal taxes in the United States, the term "levy" also has a separate, more general sense of "imposed."

Tax lien certificates are issued immediately upon the failure of the property owner to pay.

[citation needed] Tax lien states are Alabama, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maryland, Massachusetts, Mississippi, Missouri, Montana, Nebraska, Nevada, New Jersey, New York, Ohio, Rhode Island, South Carolina, Vermont, West Virginia, and Wyoming.

Tax deed states are Alaska, Arkansas, California, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Kansas, Maine, Michigan, Missouri, Nevada, New Hampshire, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia, Washington and Wisconsin.

If the property is redeemed then the investor would recover invested money, plus interest due after the lien was purchased.