2000s United States housing bubble

[5] Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets.

In their late stages, they are typically characterized by rapid increases in the valuations of real property until unsustainable levels are reached relative to incomes, price-to-rent ratios, and other economic indicators of affordability.

This may be followed by decreases in home prices that result in many owners finding themselves in a position of negative equity—a mortgage debt higher than the value of the property.

Factors include tax policy (exemption of housing from capital gains), historically low interest rates, lax lending standards, failure of regulators to intervene, and speculative fever.

[27][28][29][30][31][32] Former U.S. Federal Reserve Board Chairman Alan Greenspan said "We had a bubble in housing",[33][34] and also said in the wake of the subprime mortgage and credit crisis in 2007, "I really didn't get it until very late in 2005 and 2006.".

[46] The burst of the housing bubble was predicted by a handful of political and economic analysts, such as Jeffery Robert Hunn in a March 3, 2003, editorial.

Other cautions came as early as 2001, when the late Federal Reserve governor Edward Gramlich warned of the risks posed by subprime mortgages.

[54] The chief economist of Freddie Mac and the director of Joint Center for Housing Studies (JCHS) disputed the existence of a national housing bubble and expressed doubt that any significant decline in home prices was possible, citing consistently rising prices since the Great Depression, an anticipated increased demand from the Baby Boom generation, and healthy levels of employment.

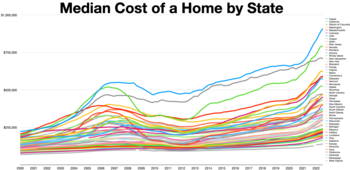

[34] Despite greatly relaxed lending standards and low interest rates, many regions of the country saw very little price appreciation during the "bubble period".

[65] During the same period, seven metropolitan areas (Tampa, Miami, San Diego, Los Angeles, Las Vegas, Phoenix, and Washington, D.C.) appreciated by more than 80%.

San Diego and Los Angeles had maintained consistently high appreciation rates since late 1990s, whereas the Las Vegas and Phoenix bubbles did not develop until 2003 and 2004 respectively.

This was also true of some cities in the Rust Belt such as Detroit[67] and Cleveland,[68] where weak local economies had produced little house price appreciation early in the decade but still saw declining values and increased foreclosures in 2007.

[69] Prior to the real estate market correction of 2006–2007, the unprecedented increase in house prices starting in 1997 produced numerous wide-ranging effects in the economy of the United States.

[77] In March 2008, Thomson Financial reported that the "Chicago Federal Reserve Bank's National Activity Index for February sent a signal that a recession [had] probably begun".

[79] On June 16, 2010, it was announced that Fannie Mae and Freddie Mac would be delisted from the New York Stock Exchange; shares now trade on the over-the-counter market.

[80] NAR chief economist David Lereah's explanation, "What Happened", from the 2006 NAR Leadership Conference[81] Basing their statements on historic U.S. housing valuation trends,[1][82] in 2005 and 2006 many economists and business writers predicted market corrections ranging from a few percentage points to 50% or more from peak values in some markets,[27][83][84][85][86][87] and although this cooling had not yet affected all areas of the U.S., some warned that it still could, and that the correction would be "nasty" and "severe".

[88][89] Chief economist Mark Zandi of the economic research firm Moody's Economy.com predicted a "crash" of double-digit depreciation in some U.S. cities by 2007–2009.

"[92] To better understand how the mortgage crisis played out, a 2012 report from the University of Michigan analyzed data from the Panel Study of Income Dynamics (PSID), which surveyed roughly 9,000 representative households in 2009 and 2011.

[98] The manager of the world's largest bond fund, PIMCO, warned in June 2007 that the subprime mortgage crisis was not an isolated event and would eventually take a toll on the economy and ultimately have an impact in the form of impaired home prices.

[99] Bill Gross, a "most reputable financial guru",[11] sarcastically and ominously criticized the credit ratings of the mortgage-based CDOs now facing collapse: AAA?

[11]Business Week has featured predictions by financial analysts that the subprime mortgage market meltdown would result in earnings reductions for large Wall Street investment banks trading in mortgage-backed securities, especially Bear Stearns, Lehman Brothers, Goldman Sachs, Merrill Lynch, and Morgan Stanley.

[102] Peter Schiff, president of Euro Pacific Capital, argued that if the bonds in the Bear Stearns funds were auctioned on the open market, much weaker values would be plainly revealed.

"[103] The New York Times report connects the hedge fund crisis with lax lending standards: "The crisis this week from the near collapse of two hedge funds managed by Bear Stearns stems directly from the slumping housing market and the fallout from loose lending practices that showered money on people with weak, or subprime, credit, leaving many of them struggling to stay in their homes.

"[102] On August 9, 2007, BNP Paribas announced that it could not fairly value the underlying assets in three funds because of its exposure to U.S. subprime mortgage lending markets.

asserted that a government bailout of subprime borrowers was not in the best interests of the U.S. economy because it would simply set a bad precedent, create a moral hazard, and worsen the speculation problem in the housing market.

Lou Ranieri of Salomon Brothers, creator of the mortgage-backed securities market in the 1970s, warned of the future impact of mortgage defaults: "This is the leading edge of the storm ...

[106] Former Federal Reserve Chairman Alan Greenspan had praised the rise of the subprime mortgage industry and the tools which it uses to assess credit-worthiness in an April 2005 speech.

[108][109] On October 15, 2008, Anthony Faiola, Ellen Nakashima and Jill Drew wrote a lengthy article in The Washington Post titled, "What Went Wrong".