United Kingdom national debt

The UK national debt is often confused with the government budget deficit (officially known as the Public Sector Net Cash Requirement (PSNCR)).

For example, the then Prime Minister David Cameron was reprimanded in February 2013 by the UK Statistics Authority for creating confusion between the two, by stating in a political broadcast that his administration was "paying down Britain's debts".

George Osborne, the Chancellor, said that it was "a stark reminder of the debt problems facing our country", adding that "we will go on delivering the plan that has cut the deficit by a quarter".

[13] Further downgrades were made by Fitch and Standard & Poor's in June 2016, following the UK's vote in the referendum of that month to leave the European Union.

By contrast, the Labour Party tends to advocate fewer cuts and more emphasis on economic stimulus, higher rates of taxation on wealthier individuals and corporations and new taxes for those.

The view proposed by economists such as Professor Stephanie Kelton of Stony Brook University in New York is that there is often too much emphasis in political discussions on 'balancing the books'.

This syndicate soon evolved into the Bank of England, eventually financing the wars of the Duke of Marlborough and later imperial conquests.

The Prime Minister was forced to apply to the International Monetary Fund for a £2.3 billion rescue package; the largest-ever call on IMF resources up to that point.

[16] In November 1976, the IMF announced its conditions for a loan, including deep cuts in public expenditure, in effect taking control of UK domestic policy.

[19] During the Spending Review of 2000, Labour began to pursue a looser fiscal policy, and by 2002 annual borrowing had reached £20 billion.

This was due to extra government borrowing, largely caused by increased spending on health, education, and social security benefits.

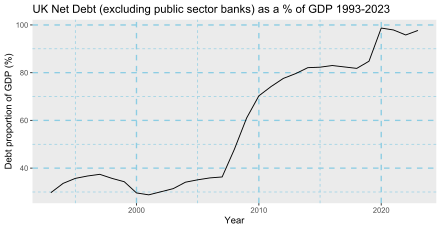

[11] Between 2008 and 2013, when the British economy slowed sharply and fell into recession, the national debt rose dramatically, mainly caused by increased spending on social security benefits, financial bailouts for banks, and a significant drop in receipts from stamp duty, corporate tax, and income tax.

There is concern that official calculations of national debt omit many 'off-book' liabilities which mask the true nature of the debt: for example, Nick Silver of the Institute of Economic Affairs estimated the current British liabilities, including state and public pensions, as well as other commitments by the government, to be near £5 trillion, compared with the Government's estimate of £845 billion (as of 17 November 2010)[25] These liabilities can be compared to total net assets (2010 figures) of £7.3 trillion, which equates to approximately a net worth of £120,000 per head of the population.

[26] Based on such a method of calculation, UK national debt would be equivalent to, or potentially exceed, historic highs.