Consumer price index

International organizations like the Organisation for Economic Co-operation and Development (OECD) report statistical figures like the consumer price index for many of its member countries.

For some of these lower-level indices detailed reweighting to make them be available,[clarification needed] allowing computations where the individual price observations can all be weighted.

[clarification needed] This may be the case, for example, where all selling is in the hands of a single national organization which makes its data available to the index compilers.

However, all countries conduct periodical household-expenditure surveys and all produce breakdowns of consumption expenditure in their national accounts.

Statistics of retail sales and market research reports can provide information for estimating outlet-type breakdowns, but the classifications they use rarely correspond to COICOP categories.

Thus response burden is markedly reduced, accuracy is increased, product description is more specific and point of purchase data are obtained, facilitating the estimation of outlet-type weights.

Infrequent reweighting saves costs for the national statistical office but delays the introduction into the index of new types of expenditure.

The way in which owner-occupied dwellings should be dealt with in a consumer price index has been, and remains, a subject of heated controversy in many countries.

Although the argument has been expressed in connection with owner-occupied dwellings, the logic applies equally to all durable consumer goods and services.

Since estimating values for these components of consumption has not been tackled, economic theorists are torn between their desire for intellectual consistency and their recognition that including the opportunity cost of the use of durables is impracticable.

Everyone agrees that repairs and maintenance expenditures for owner-occupied dwellings should be covered by a consumer price index, but the spending approach would include mortgage interest too.

Thus, her current index with 1999 as a reference period will stand at more than 100 if house prices or, in the case of a fixed-interest mortgage, interest rates rose between 2006 and 2007.

The application of this principle in the owner-occupied dwellings component of a consumer price index is known as the "debt profile" method.

It means that the current movement of the index will reflect past changes in dwelling prices and interest rates.

This means: Furthermore, expenditure on enlarging or reconstructing an owner-occupied dwelling would be covered, in addition to regular maintenance and repair.

One argument is that purchases of new dwellings are treated as "investment" in the system of national accounts and should not enter a consumption price index.

For example, it may be thought to help understand and facilitate economic analysis if what is included under the heading "consumption" is the same in the consumer price index and in the national income and expenditure accounts.

The other argument is that the prices of new dwellings should exclude that part reflecting the value of the land, since this is an irreproducible and permanent asset that cannot be said to be consumed.

Dislike of the effect on the behavior of the consumer price index arising from the adoption of some methods can be a powerful, if sometimes unprincipled, argument.

In the United States several different consumer price indices are routinely computed by the Bureau of Labor Statistics (BLS).

First, the BLS collects data to estimate 8,018 separate item–area indices reflecting the prices of 211 categories of consumption items in 38 geographical areas.

[13] This allows the BLS to compute consumer price indices for each of the designated 38 geographical areas and for aggregates like the Midwest.

It is based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W)".

[15] The use of CPI-W conflicts with this purpose, because the elderly consume substantially more health care goods and services than younger people.

Since the weight on health care in CPI-W is much less than the consumption patterns of the elderly, this COLA does not adequately compensate them for the real increases in the costs of the items they buy.

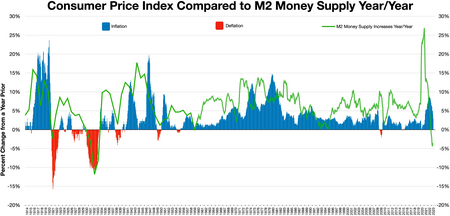

In response Jerome Powell, chair of the Federal Reserve has begun Quantitative tightening with rate hikes expected to begin in March 2022.

Senator Alan K. Simpson suggested a transition to using a "chained CPI" in 2010, when they headed the White House's deficit-reduction commission.

[23] However, the National Active and Retired Federal Employees Associations said that the chained CPI does not account for seniors citizens' health care costs.

[23] Robert Reich, former United States Secretary of Labor under President Clinton, noted that typical seniors spend between 20 and 40 percent of their income on health care, far more than most Americans.

[24] Because of some shortcomings of the CPI, notably that it uses static expenditure weighting and it does not account for the substitution effect, the PCEPI is an alternative price index used by the Federal Reserve, among others, to measure inflation.