Inflation

[3][4][5][6] When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money.

Positive effects include reducing unemployment due to nominal wage rigidity,[11] allowing the central bank greater freedom in carrying out monetary policy, encouraging loans and investment instead of money hoarding, and avoiding the inefficiencies associated with deflation.

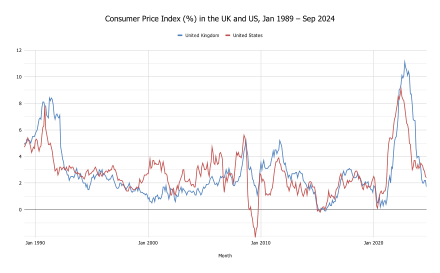

[28] Historically, inflations of varying magnitudes have occurred, interspersed with corresponding deflationary periods,[26] from the price revolution of the 16th century, which was driven by the flood of gold and particularly silver seized and mined by the Spaniards in Latin America, to the largest paper money inflation of all time in Hungary after World War II.

[30] Alexander the Great's conquest of the Persian Empire in 330 BCE was followed by one of the earliest documented inflation periods in the ancient world.

A contemporary Arab historian remarked about Mansa Musa's visit: Gold was at a high price in Egypt until they came in that year.

The resulting inflation rate for the CPI in this one-year period is 4.28%, meaning the general level of prices for typical U.S. consumers rose by approximately four percent in 2007.

For example, home heating costs are expected to rise in colder months, and seasonal adjustments are often used when measuring inflation to compensate for cyclical energy or fuel demand spikes.

[70] An alternative theory, the real bills doctrine (RBD), originated in the 17th and 18th century, receiving its first authoritative exposition in Adam Smith's The Wealth of Nations.

[72] The debate between currency, or quantity theory, and banking schools during the 19th century prefigures current questions about the credibility of money in the present.

[73] John Maynard Keynes in his 1936 main work The General Theory of Employment, Interest and Money emphasized that wages and prices were sticky in the short run, but gradually responded to aggregate demand shocks.

The curve was interpreted to imply that a country could achieve low unemployment if it were willing to tolerate a higher inflation rate or vice versa.

The formula itself is simply an uncontroversial accounting identity because the velocity of money (V) is defined residually from the equation to be the ratio of final nominal expenditure (

[76]: 99 Monetarists assumed additionally that the velocity of money is unaffected by monetary policy (at least in the long run), that the real value of output is also exogenous in the long run, its long-run value being determined independently by the productive capacity of the economy, and that money supply is exogenous and can be controlled by the monetary authorities.

[10]: 528–529 This line of thinking led to the concept of potential output (sometimes called the "natural gross domestic product"), a level of GDP where the economy is stable in the sense that inflation will neither decrease nor increase.

[10] If GDP exceeds its potential (and unemployment consequently is below the NAIRU), the theory says that inflation will accelerate as suppliers increase their prices.

Eventually, a consensus was established that the break-down was due to agents changing their inflation expectations, confirming Friedman's theory.

[26][10]: 529 During the 1980s a group of researchers named new Keynesians emerged who accepted many originally non-Keynesian concepts like the importance of monetary policy, the existence of a natural level of unemployment and the incorporation of rational expectations formation as a reasonable benchmark.

[10] Consequently, demand shocks, supply shocks and inflation expectations are all potentially important determinants of inflation,[81] confirming the basis of the older triangle model by Robert J. Gordon:[82] The important role of rational expectations is recognized by the emphasis on credibility on the part of central banks and other policy-makers.

[86]: 608 However, while more disputed in the 1970s, surveys of members of the American Economic Association (AEA) since the 1990s have shown that most professional American economists generally agree with the statement "Inflation is caused primarily by too much growth in the money supply", while the same surveys have shown a lack of consensus by AEA members since the 1990s that "In the short run, a reduction in unemployment causes the rate of inflation to increase" has developed despite more agreement with the statement in the 1970s.

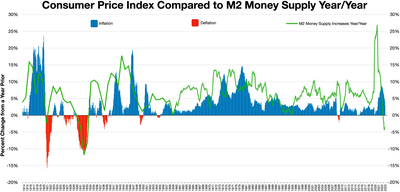

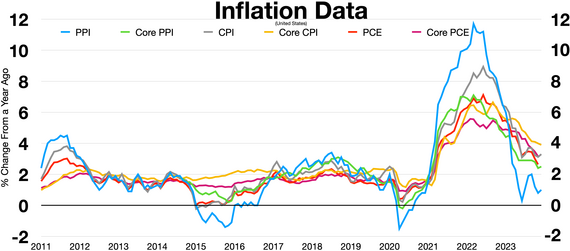

During the COVID pandemic and its immediate aftermath, the M2 money supply increased at the fastest rate in decades, leading some to link the growth to the 2021-2023 inflation surge.

Fed chairman Jerome Powell said in December 2021 that the once-strong link between the money supply and inflation "ended about 40 years ago," due to financial innovations and deregulation.

The broadest measure of money supply, M3, increased about 45% from 2010 through 2015, far faster than GDP growth, yet the inflation rate declined during that period — the opposite of what monetarism would have predicted.

For example, with inflation, those segments in society which own physical assets, such as property, stock etc., benefit from the price/value of their holdings going up, when those who seek to acquire them will need to pay more for them.

Increases in the price level (inflation) erode the real value of money (the functional currency) and other items with an underlying monetary nature.

[111] Inflation hurts asset prices such as stock performance in the short-run, as it erodes non-energy corporates' profit margins and leads to central banks' policy tightening measures.

Annual escalation clauses in employment contracts can specify retroactive or future percentage increases in worker pay which are not tied to any index.

Historically, central banks and governments have followed various policies to achieve low inflation, employing various nominal anchors.

Before World War I, the gold standard was prevalent, but was eventually found to be detrimental to economic stability and employment, not least during the Great Depression in the 1930s.

Via the monetary transmission mechanism interest rate changes affect aggregate demand in various ways, causing output and employment to respond.

[140][141] The gold standard was historically found to make it more difficult to stabilize employment levels and avoid recessions and was eventually abandoned everywhere.