Fiscal policy

The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable.

Additionally, fiscal policy can potentially have more supply-side effects on the economy: to reduce inflation, the measures of increasing taxes and lowering spending would not be preferred, so the government might be reluctant to use these.

Monetary policy is generally quicker to implement as interest rates can be set every month, while the decision to increase government spending might take time to figure out which area the money should be spent on.

A liquidity trap occurs when interest rate cuts are insufficient as a demand booster as banks do not want to lend and the consumers are reluctant to increase spending due to negative expectations for the economy.

[4] In 2000, a survey of 298 members of the American Economic Association (AEA) found that while 84 percent generally agreed with the statement "Fiscal policy has a significant stimulative impact on a less than fully employed economy", 71 percent also generally agreed with the statement "Management of the business cycle should be left to the Federal Reserve; activist fiscal policy should be avoided.

"[5] In 2011, a follow-up survey of 568 AEA members found that the previous consensus about the latter proposition had dissolved and was by then roughly evenly disputed.

Governments spend money on a wide variety of things, from the military and police to services such as education and health care, as well as transfer payments such as welfare benefits.

The concept of a fiscal straitjacket is a general economic principle that suggests strict constraints on government spending and public sector borrowing, to limit or regulate the budget deficit over a time period.

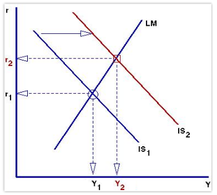

Therefore, the IS-LM model shows that there will be an overall increase in the price level and real interest rates in the long run due to fiscal expansion.

The argument mostly centers on crowding out: whether government borrowing leads to higher interest rates that may offset the stimulative impact of spending.

This decreases aggregate demand for goods and services, either partially or entirely offsetting the direct expansionary impact of the deficit spending, thus diminishing or eliminating the achievement of the objective of a fiscal stimulus.

[8] In the classical view, expansionary fiscal policy also decreases net exports, which has a mitigating effect on national output and income.

This is because, all other things being equal, the bonds issued from a country executing expansionary fiscal policy now offer a higher rate of return.