International tax planning

Later the Organisation for Economic Co-operation and Development (OECD) expanded these directives and proposed a new international system for the automatic exchange of information – known as the Common Reporting Standard (CRS).

In December 2017, European Union finance ministers blacklisted 17 countries for refusing to co-operate in its investigation on tax havens.

EWP addresses the concerns of law firms and international planners about some aspects of CRS related to their clients' privacy.

[7][8][9] EWP assists with the privacy and welfare of families by protecting their financial records and keeping them in compliance with tax regulations.

[11] EWP includes transfers of assets without forced heirship rules directly to beneficiaries using a controlled and orderly plan.

This element of EWP provides a wealth holder a method to enact an estate plan according to his/her wishes without complying forced heirship rules in the home country.

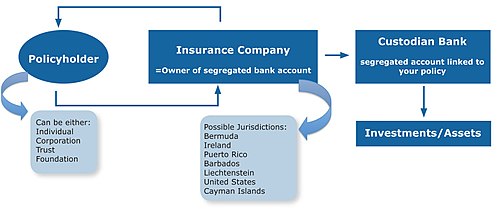

[14] This approach greatly simplifies reporting obligations to tax authorizes because assets in the policy are held in segregated accounts and can be spread over multiple jurisdictions worldwide.