Ireland as a tax haven

In 2018, IP–heavy S&P500 multinationals guided similar post-TCJA effective tax rates, whether they are legally based in the U.S. (e.g. Pfizer[h]), or Ireland (e.g. Medtronic[h]).

[m][28] Ireland has been a consistent feature on almost every non-governmental tax haven list from Hines in February 1994,[29] to Zucman in June 2018[30] (and each one in-between).

[3][5] These two contrasting facts are used by various sides, to allegedly prove or disprove that Ireland is a tax haven, and much of the detail in-between is discarded, some of which can explain the EU and OCED's position.

The final section chronicles the academic research on the drivers of U.S., EU, and OCED, decision making regarding Ireland.

[102] The Irish Cabinet approved an increase from 12.5% to 15% in corporation tax for companies with turnover in excess of 750 million euros.

[116][117] By refusing to implement the 2013 EU Accounting Directive (and invoking exemptions on reporting holding company structures until 2022), Ireland enables their TP and IP–based BEPS tools to structure as "unlimited liability companies" ("ULC") which do not have to file public accounts with the Irish CRO.

[130][131] Unlike the TP and IP–based BEPS tools, Section 110 SPVs must file public accounts with the Irish CRO, which was how the above abuses were discovered in 2016–17.

In February 2018 the Central Bank of Ireland upgraded the little-used L–QIAIF regime to give the same tax benefits as Section 110 SPVs but without having to file public accounts.

Apple's Q1 2015 Irish restructure, post their €13 billion EU tax fine for 2004–2014, is one of the most advanced OECD-compliant BEPS tools in the world.

The €26.220 billion jump in intangible capital allowances claimed in 2015,[138] showed Apple Ireland is writing-off this IP–asset over a 10-year period.

[140] Because Irish intangible capital allowances are accepted as U.S. GILTI deductions,[141] the "Green Jersey" now enables U.S. multinationals to achieve net effective U.S. corporate tax rates of 0% to 2.5% via TCJA's participation relief.

[147][148] While they are regulated by the Central Bank of Ireland, like the Section 110 SPV, it has been shown many are effectively unregulated "brass plate" entities.

In February 2018, the Central Bank of Ireland, which regulates Section 110 SPVs, upgraded the little used tax-free L-QIAIF regime, which has stronger privacy from public scrutiny.

In a letter to him the group recommended Ireland not adopt article 12, as the changes "will have effects lasting decades" and could "hamper global investment and growth due to uncertainty around taxation".

[185] When Tim Cook stated in 2016 that Apple was the largest tax-payer in Ireland, the Irish Revenue Commissioners quoted Section 815A of the 1997 Tax Acts that prevents them disclosing such information, even to members of Dáil Éireann, or the Irish Department of Finance (despite the fact that Apple is circa one-fifth of Ireland's GDP).

[186] Commentators note the plausible deniability provided by Irish privacy and data protection laws, that enable the State to function as a tax haven while maintaining OECD compliance.

They ensure the State entity regulating each tax tool are "siloed" from the Irish Revenue, and public scrutiny via FOI laws.

[189] In April 2019, Politico reported on concerns that Ireland was protecting Facebook and Google from the new EU GDPR regulations, stating: "Despite its vows to beef up its threadbare regulatory apparatus, Ireland has a long history of catering to the very companies it is supposed to oversee, having wooed top Silicon Valley firms to the Emerald Isle with promises of low taxes, open access to top officials, and help securing funds to build glittering new headquarters.

[203] Independent studies show that Ireland's aggregate effective corporate tax rate is between 2.2% to 4.5% (depending on assumptions made).

Salary taxes, VAT, and CGT for Irish residents are in line with rates of other EU–28 countries, and tend to be slightly higher than EU–28 averages in many cases.

[244] The Irish State dismisses academic studies which list Ireland as a tax haven as being "out-of-date", because they cite the 1994 Hines–Rice paper.

[245][246] The Irish State ignores the fact that both Hines, and all the other academics, developed new lists; or that the Hines–Rice 1994 paper is still considered correct (e.g. per the 2017 U.S. TCJA legislation).

[199] This unique talent base is also noted by IDA Ireland, the State body responsible for attracting inward investment, but never defined beyond the broad concept.

[248][252][253] Ireland continues to pursue this strategy and is considering re-classifying the remaining Irish technical institutes as universities for 2019.

[254] Ireland shows no apparent distinctiveness in any non-tax related metrics of business competitiveness including cost of living,[255][256][257] league tables of favoured EU FDI locations,[258] league tables of favoured EU destinations for London-based financials post-Brexit (which are linked to quality of talent),[259] and the key World Economic Forum Global Competitiveness Report rankings.

[266] This Irish "employment tax" requirement for use of BEPS tools, and its fulfilment via foreign work-visas, is a driver of Dublin's housing crisis.

[267] This is consistent with a bias to property development-led economic growth, favoured by the main Irish political parties (see Abuse of QIAIFs).

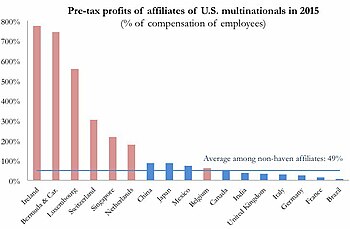

[16] No other non-haven OECD country records as high a share of foreign profits booked in tax havens[t] as the United States.

[284] Brexit was initially disappointing for Ireland in the area of attracting financial services firms from London, but the situation later improved.

In writing its report, the IMF conducted confidential anonymous interviews with Irish corporate tax experts.

Setser & Frank ( CoFR ), [ 111 ]