Short (finance)

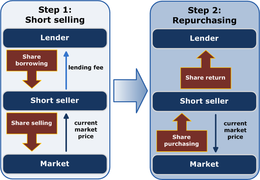

If the market value of the asset has fallen in the meantime, the short seller will have made a profit equal to the difference.

Short selling is a common practice in public securities, futures, and currency markets that are fungible and reasonably liquid.

[9] Short selling can exert downward pressure on the underlying stock, driving down the price of shares of that security.

This, combined with the seemingly complex and hard-to-follow tactics of the practice, has made short selling a historical target for criticism.

The bank had been speculating by shorting East India Company stock on a massive scale, and apparently using customer deposits to cover losses.

In another well-referenced example, George Soros became notorious for "breaking the Bank of England" on Black Wednesday of 1992, when he sold short more than $10 billion worth of pounds sterling.

[13] Political fallout from the 1929 crash led Congress to enact a law banning short sellers from selling shares during a downtick; this was known as the uptick rule and was in effect until 3 July 2007, when it was removed by the Securities and Exchange Commission (SEC Release No.

[citation needed] During the 2008 financial crisis, critics argued that investors taking large short positions in struggling financial firms like Lehman Brothers, HBOS and Morgan Stanley created instability in the stock market and placed additional downward pressure on prices.

[17][18] Temporary short-selling bans were also introduced in the United Kingdom, Germany, France, Italy and other European countries in 2008 to minimal effect.

[22][23] Worldwide, economic regulators seem inclined to restrict short selling to decrease potential downward price cascades.

Brokers have a variety of means to borrow stocks to facilitate locates and make good on delivery of the shorted security.

The vast majority of stocks borrowed by U.S. brokers come from loans made by the leading custody banks and fund management companies (see list below).

These can be useful tools to spot trends in stock price movements but for them to be reliable, investors must also ascertain the number of shares brought into existence by naked shorters.

[28] This has important implications for derivatives pricing and strategy, for the borrow cost itself can become a significant convenience yield for holding the stock (similar to additional dividend) – for instance, put–call parity relationships are broken and the early exercise feature of American call options on non-dividend paying stocks can become rational to exercise early, which otherwise would not be economical.

More stringent rules were put in place in September 2008, ostensibly to prevent the practice from exacerbating market declines.

When a security's ex-dividend date passes, the dividend is deducted from the shortholder's account and paid to the person from whom the stock is borrowed.

Shorting a futures contract is sometimes also used by those holding the underlying asset (i.e. those with a long position) as a temporary hedge against price declines.

Stock is held only long enough to be sold pursuant to the contract, and one's return is therefore limited to short term capital gains, which are taxed as ordinary income.

"[32] To manage its own risk, the broker requires the short seller to keep a margin account, and charges interest of between 2% and 8% depending on the amounts involved.

[33] In 2011, the eruption of the massive China stock frauds on North American equity markets brought a related risk to light for the short seller.

Short selling can have negative implications if it causes a premature or unjustified share price collapse when the fear of cancellation due to bankruptcy becomes contagious.

Thus, from that point in time, the profit is locked in (less brokerage fees and short financing costs), regardless of further fluctuations in the underlying share price.

[38] In January 2005, The Securities and Exchange Commission enacted Regulation SHO to target abusive naked short selling.

However, some brokerage firms that specialize in penny stocks (referred to colloquially as bucket shops) have used the lack of short selling during this month to pump and dump thinly traded IPOs.

[42] The Securities and Exchange Commission initiated a temporary ban on short selling of 799 financial stocks from 19 September 2008 until 2 October 2008.

[44] After the ban was lifted, John McFall, chairman of the Treasury Select Committee, House of Commons, made clear in public statements and a letter to the FSA that he believed it ought to be extended.

[49] By contrast with the approach taken by other countries, Chinese regulators responded by allowing short selling, along with a package of other market reforms.

[50] Short selling was completely allowed on 31 March 2010, limited to " for large blue chip stocks with good earnings performance and little price volatility.

[56] Shortseller James Chanos received widespread publicity when he was an early critic of the accounting practices of Enron.

[60] Commentator Jim Cramer has expressed concern about short selling and started a petition calling for the reintroduction of the uptick rule.