Statistical arbitrage

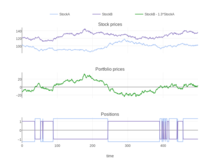

In finance, statistical arbitrage (often abbreviated as Stat Arb or StatArb) is a class of short-term financial trading strategies that employ mean reversion models involving broadly diversified portfolios of securities (hundreds to thousands) held for short periods of time (generally seconds to days).

[1] Broadly speaking, StatArb is actually any strategy that is bottom-up, beta-neutral in approach and uses statistical/econometric techniques in order to provide signals for execution.

Because of the large number of stocks involved, the high portfolio turnover and the fairly small size of the effects one is trying to capture, the strategy is often implemented in an automated fashion and great attention is placed on reducing trading costs.

[3] StatArb considers not pairs of stocks but a portfolio of a hundred or more stocks—some long, some short—that are carefully matched by sector and region to eliminate exposure to beta and other risk factors.

The 1998 default of Long-Term Capital Management was a widely publicized example of a fund that failed due to its inability to post collateral to cover adverse market fluctuations.

During July and August 2007, a number of StatArb (and other Quant type) hedge funds experienced significant losses at the same time, which is difficult to explain unless there was a common risk factor.

While the reasons are not yet fully understood, several published accounts blame the emergency liquidation of a fund that experienced capital withdrawals or margin calls.

[7] One of the versions of the events describes how Morgan Stanley's highly successful StatArb fund, PDT, decided to reduce its positions in response to stresses in other parts of the firm, and how this contributed to several days of hectic trading.

These events showed that StatArb has developed to a point where it is a significant factor in the marketplace, that existing funds have similar positions and are in effect competing for the same returns.

In many countries where the trading security or derivatives are not fully developed, investors find it infeasible or unprofitable to implement statistical arbitrage in local markets.