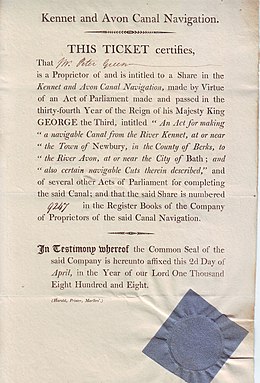

Stock certificate

In corporate law, a stock certificate (also known as certificate of stock or share certificate) is a legal document that certifies the legal interest (a bundle of several legal rights) of ownership of a specific number of shares (or, under Article 8 of the Uniform Commercial Code in the United States, a securities entitlement or pro rata share of a fungible bulk) or stock in a corporation.

[3] In the United States over 420 of the 7,000-plus publicly traded securities, 6%, do not issue paper certificates to beneficial owners.

[6][7][8][9] In 2012, water from Hurricane Sandy flooded a vault at the DTC, damaging over $1 billion in stock and bond certificates.

[10] Brokers may charge up to $500 for issuing a paper certificate, though some charge zero (e.g., The Walt Disney Company) or only a modest fee, and this fee can be avoided by either holding shares in street name (in the United States street name securities are securities held, usually in paper certificate form, by a partnership of a financial institution (such as a broker or bank or central securities depository), where the beneficial owner only receives a statement, similar to a bank account statement) or registering shares directly with the stock transfer agent and having them issue the certificate.

[13] Bearer stock certificates are becoming uncommon: they were popular in offshore jurisdictions for their perceived confidentiality,[13] and as a useful way to transfer beneficial title to assets (held by the corporation) without payment of stamp duty, post-issuance.

[14] International initiatives have curbed the use of bearer stock certificates in offshore jurisdictions, and tend to be available only in onshore financial centres, although they are rarely seen in practice.