The Return of Depression Economics and the Crisis of 2008

Krugman offers policy recommendations for the prevention of future financial crises and suggests that policymakers "relearn the lessons our grandfathers were taught by the Great Depression" and prop up spending and enable broader access to credit.

In response to the GFC, Krugman expressed his dissatisfaction with modern macroeconomic policy in the New York Times article How Did Economists Get It So Wrong?, highlighting what he considered the failure of neoclassical economics (i.e., Robert Lucas and Eugene Fama's efficient market hypothesis).

[9] Outside of academia, Krugman has written on numerous macroeconomic issues relating to trade, healthcare, social policy and politics articles for the broader public in Foreign Affairs, Harvard Business Review, Scientific American .

As such, he argues for the incorporation of behavioural economics in the pursuit of policy and regulation of markets, to counteract the consequences of irrational decision making.

Krugman provides an accessible read to a broad range of audiences, including academics and non-academics, as he compares the economic settings, policies and features that contributed to a financial crisis.

Krugman suggests that despite Japan being the second largest economy at the time, and a creditor nation, financial liberalisation, and deregulation in the 1980s led to deflation and a recession.

[5][4] This chapter outlines that sequence of events following the devaluation of the Thai Baht in 1997 which had a flow on effect on Malaysia's ringgit, Indonesia and even South Korea.

Consequently, when the Thai government maintained a fixed exchange rate, the economy ran a deficit 8% of GDP with imports exceeding exports.

[5][4] Krugman criticises International Monetary Fund and US Treasury policy response to the Asian Financial Crisis which focused on managing speculation and restoring market confidence.

He provides insights into the role of hedge funds in the Asian financial crisis and George Soros and the British Pound and Ruble.

He details the flourishing economic conditions in which Greenspan became the chairman of the Federal Reserve and his subsequent reluctance to raise interest rates.

Greenspan then lowered the interest rate to 1% which eventually stimulated the economy but led to larger mortgages, increased prices, and the housing bubble.

[5][4] Krugman highlights the importance of identifying bubbles and isolates similarities between the onset of the GFC, The Great Depression, Japan's lost decade and the Asian financial crisis.

He thoroughly analyses the symptoms leading to the GFC including US liquidity, disruption of capital flows and a bursting real-estate bubble that deflated in 2005, but wasn't noticed until 2006.

[5][4] Krugman strongly advocates for fiscal expenditure, a key Keynesian doctrine, to boost aggregate demand and economic output.

[4] Krugman challenges the dominant neoclassical paradigm's ability to predict the business cycle, but Rankin acknowledges a more constructive critique is required.

An increase in government income can be funded by debt or tax, and although neither will more effectively stimulate the economy according to the Ricardian equivalence theorem, will each have differing socio-political and economic implications which Krugman does not explore.

Concurring with Cochrane, Ritenour criticises Krugman's belief in the inherent instability of the free market and assumption that prices are relatively inelastic in response to surpluses in demand or supply.

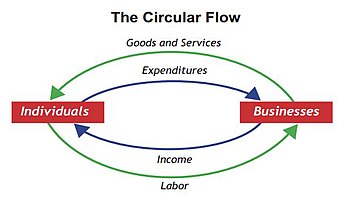

[3] Allocation of resources is most efficient with government intervention according to Krugman, but Ritenour suggests that free markets give more choice and incentive to save and spend wisely in the area of most public demand.

[2] Economists such as Cochrane, Ritenour and Keith Rankin, criticise the oversimplification of necessary mathematical models and suggest that without these, the arguments lack logic and consistency.

Krugman does not differentiate between the types of actors, whether public or private, nor the different geographical scales in which they operate, and therefore offers little acknowledgement of the complex interdependent dynamics in a global financial environment.

[2] These loose economic foundations produce policy recommendations that may lack scientific rigour according to some economist,[3][2] and while the important ideas are covered, no alternative analysis is provided.

Ritenour states that Krugman "overlooks the 'catalyst' of economic panic in the Latin and Asian crisis", the rapid increase in money supply and inflation.

[6] In a similar line of thought, Rankin states that Krugman is "unable to extend his message beyond the combined insights of Keynes and findings of new behavioural economist".

[3] Krugman and Hick share overarching concerns that demand failures cause liquidity traps and pervading negative natural interest rates.

Krugman's management of demand and inflationary expectations via monetary and credit expansion by governments, may inefficiently allocate capital to the wrong resource.

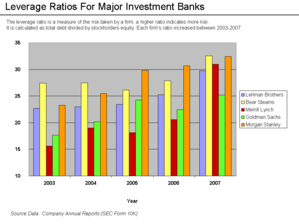

[3] Throughout the book Krugman implies that deregulation of financial markets led to bank runs and excessive risk taking at the height of the GFC.

[6] Krugman's book is mostly a macroeconomic guidebook that advocates for regulatory reform of the financial system, including the reduction of interest rates and increasing budget deficits to counter recessions.

[2] In the post-pandemic world with decreased demand in most economies, Krugman's book may be more relevant today considering the increase in welfare economics favouring public health.

Given the current scenario, Krugman's comments on preventing a liquidity and solvency crisis would suggest similar policy recommendations to those mentioned in his book.